EX-99.2

Published on December 1, 2025

Fourth Quarter and Full Year Fiscal 2025 Results Strategic Business Transformation December 2, 2025

Non-GAAP Measures Vestis reports its financial results in accordance with U.S. GAAP, but in this presentation and the non-GAAP reconciliations that follow, Vestis also uses the following non-GAAP measures: Normalized Revenue, Adjusted EPS, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Liquidity, Net Debt, Net Leverage Ratio, Trailing Twelve Months Covenant Adjusted EBITDA, and Return on Working Capital. Vestis believes that non-GAAP financial measures, both together with and in addition to the corresponding U.S. GAAP financial measure, are important supplemental measures that exclude non-cash or other items that may not be indicative of or are unrelated to Vestis’ core operating results. Vestis uses these non-GAAP financial measures with U.S. GAAP financial measures and other comparable tools to assist in the evaluation of its operating performance. Vestis believes that presentation of these measures also helps investors because the measures enable better comparisons of Vestis’ historical results and allow investors to evaluate Vestis’ performance based on the same metrics that Vestis uses to evaluate its performance and trends in its results. However, these measures have limitations as analytical tools and should not be considered in isolation or as a substitute for Vestis’ results as reported under U.S. GAAP. Specifically, you should not consider these measures as alternatives to revenue, operating income, operating income margin, net income, net income margin or net cash provided by operating activities determined in accordance with U.S. GAAP. These non-GAAP financial measures also should not be considered as measures of cash available to Vestis to invest in the growth of Vestis’ business or cash that will be available to Vestis to meet its obligations. Non-GAAP financial measures as presented by Vestis may not be comparable to other similarly titled measures of other companies because not all companies use identical calculations. These non-GAAP measures are reconciled in the tables at the end of this presentation. This presentation and the remarks made during the associated conference call are integrally related and are intended to be presented and understood together. Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the securities laws. All statements that reflect our expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, forecasts relating to discussions of future operations and financial performance and statements regarding our strategy for growth, future product development, regulatory approvals, competitive position and expenditures. In some cases, forward-looking statements can be identified by words such as “potential,” “outlook,” “guidance,” “anticipate,” “continue,” “estimate,” “expect,” “will,” and “believe,” and other words and terms of similar meaning or the negative versions of such words. Examples of forward-looking statements in this release include, but are not limited to, statements regarding: the potential effects and timing of our strategic business actions to enhance both our commercial and operational processes, and our expectations regarding our fiscal year 2026 performance outlook, including the information under the heading “Fiscal Year 2026 Outlook”. These forward-looking statements are subject to risks and uncertainties that may change at any time, and actual results or outcomes may differ materially from those that we expected. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict including, but not limited to: unfavorable macroeconomic conditions including inflationary pressures and higher interest rates; the failure to retain current customers, renew existing customer contracts and obtain new customer contracts, which could result in continued stock volatility and potential future goodwill impairment charges; competition in our industry; our ability to comply with certain financial ratios, tests and covenants in our credit agreement, including the Net Leverage Ratio; our significant indebtedness and ability to meet debt obligations and our reliance on an accounts receivable securitization facility; our ability to successfully execute or achieve the expected benefits of our restructuring plan and other measures we may take in the future; use of artificial intelligence in our business, which could result in reputational harm, competitive harm, and legal liability; increases in fuel and energy costs and other supply chain challenges and disruptions, including as a result of ongoing military conflicts in Ukraine and the Middle East; implementation of new or increased tariffs and ongoing changes in U.S. and foreign government trade policies, including potential modifications to existing trade agreements and retaliatory measures by foreign governments; increased operating costs and obstacles to cost recovery due to the pricing and cancellation terms of our support services contracts; a determination by our customers to reduce their outsourcing or use of preferred vendors; the outcome of legal proceedings to which we are or may become subject; risks associated with suppliers from whom our products are sourced; challenge of contracts by our customers; currency risks and other risks associated with international operations, including compliance with a broad range of laws and regulations, including the United States Foreign Corrupt Practices Act; increases in labor costs or inability to hire and retain key or sufficient qualified personnel; continued or further unionization of our workforce; our expansion strategy and our ability to successfully integrate the businesses we acquire and costs and timing related thereto; natural disasters, global calamities, climate change, pandemics, and other adverse incidents; liability resulting from our participation in multiemployer-defined benefit pension plans; liability associated with noncompliance with applicable law or other governmental regulations; laws and governmental regulations including those relating to the environment, wage and hour and government contracting; unanticipated changes in tax law; new interpretations of or changes in the enforcement of the government regulatory framework; a cybersecurity incident or other disruptions in the availability of our computer systems or privacy breaches; stakeholder expectations relating to environmental, social and governance (“ESG”) considerations which may expose us to liabilities and other adverse effects on our business; any failure by Aramark to perform its obligations under the various separation agreements entered into in connection with the separation; and a determination by the IRS that the distribution or certain related transactions are taxable. The above list of factors is not exhaustive or necessarily in order of importance. For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, see the Company’s filings with the Securities and Exchange Commission (“SEC”), including “Item 1A-Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in “Item 1A-Risk Factors” of Part II in subsequently-filed Quarterly Reports on Form 10-Q, which are available on the SEC’s website at www.sec.gov. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise such statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Notes to Investors ©2025 Vestis. All rights reserved. 2

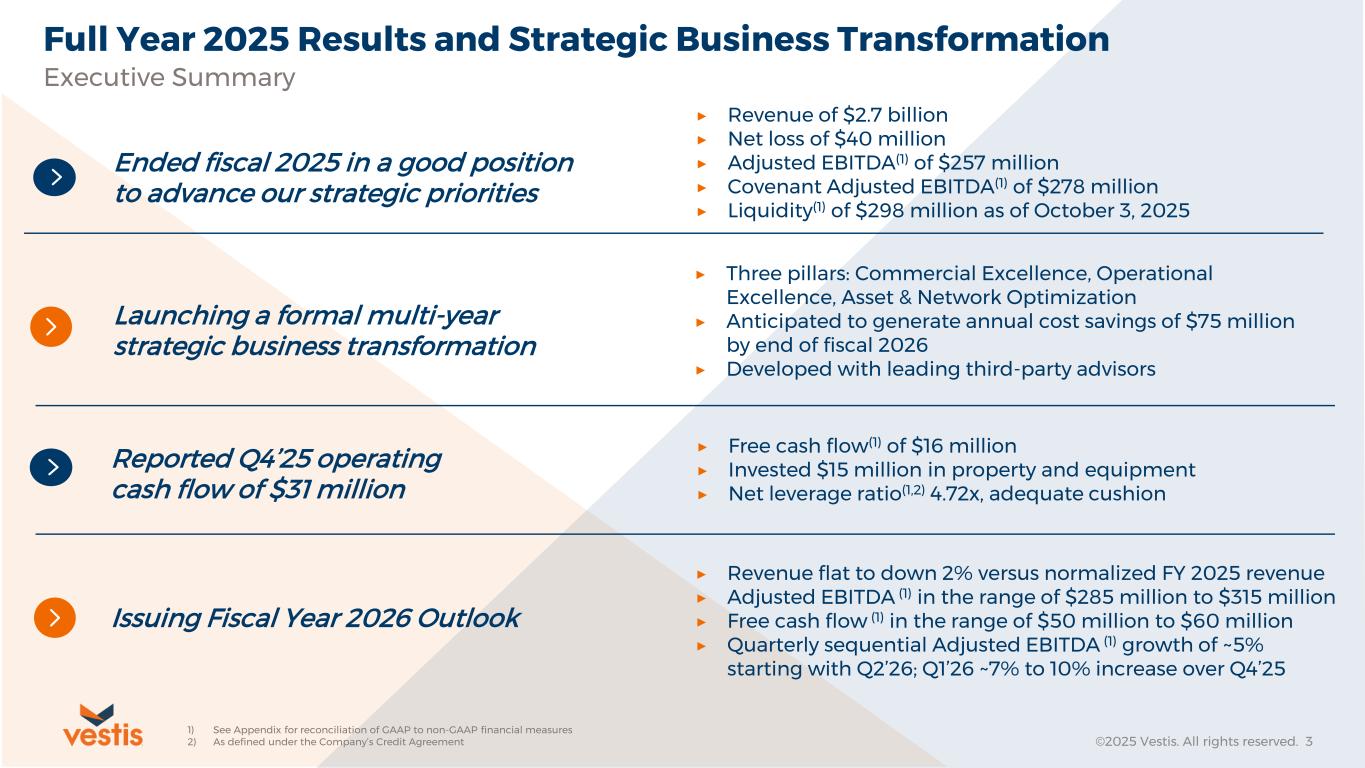

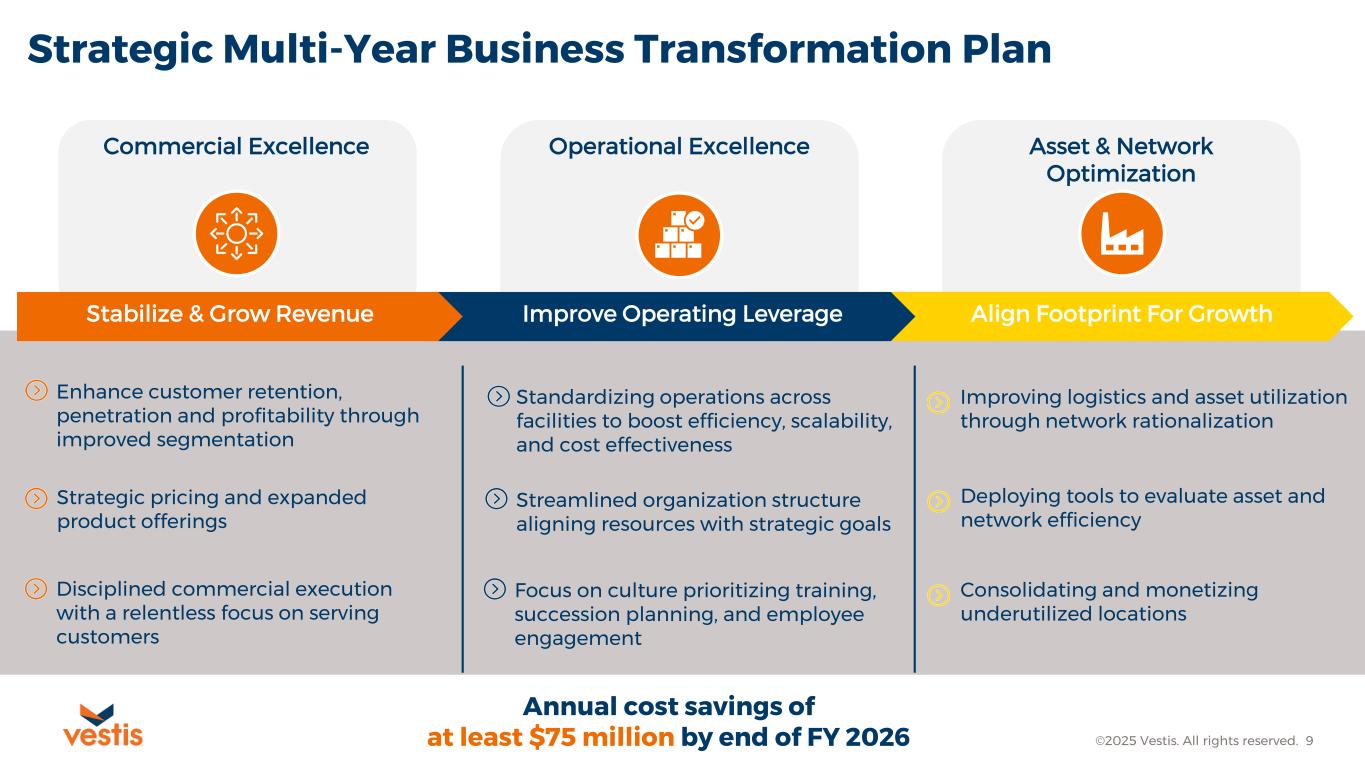

Executive Summary ©2025 Vestis. All rights reserved. 3 ▶ Revenue of $2.7 billion ▶ Net loss of $40 million ▶ Adjusted EBITDA(1) of $257 million ▶ Covenant Adjusted EBITDA(1) of $278 million ▶ Liquidity(1) of $298 million as of October 3, 2025 Full Year 2025 Results and Strategic Business Transformation Ended fiscal 2025 in a good position to advance our strategic priorities Launching a formal multi-year strategic business transformation ▶ Three pillars: Commercial Excellence, Operational Excellence, Asset & Network Optimization ▶ Anticipated to generate annual cost savings of $75 million by end of fiscal 2026 ▶ Developed with leading third-party advisors Reported Q4’25 operating cash flow of $31 million ▶ Free cash flow(1) of $16 million ▶ Invested $15 million in property and equipment ▶ Net leverage ratio(1,2) 4.72x, adequate cushion Issuing Fiscal Year 2026 Outlook ▶ Revenue flat to down 2% versus normalized FY 2025 revenue ▶ Adjusted EBITDA (1) in the range of $285 million to $315 million ▶ Free cash flow (1) in the range of $50 million to $60 million ▶ Quarterly sequential Adjusted EBITDA (1) growth of ~5% starting with Q2’26; Q1’26 ~7% to 10% increase over Q4’25 1) See Appendix for reconciliation of GAAP to non-GAAP financial measures 2) As defined under the Company’s Credit Agreement

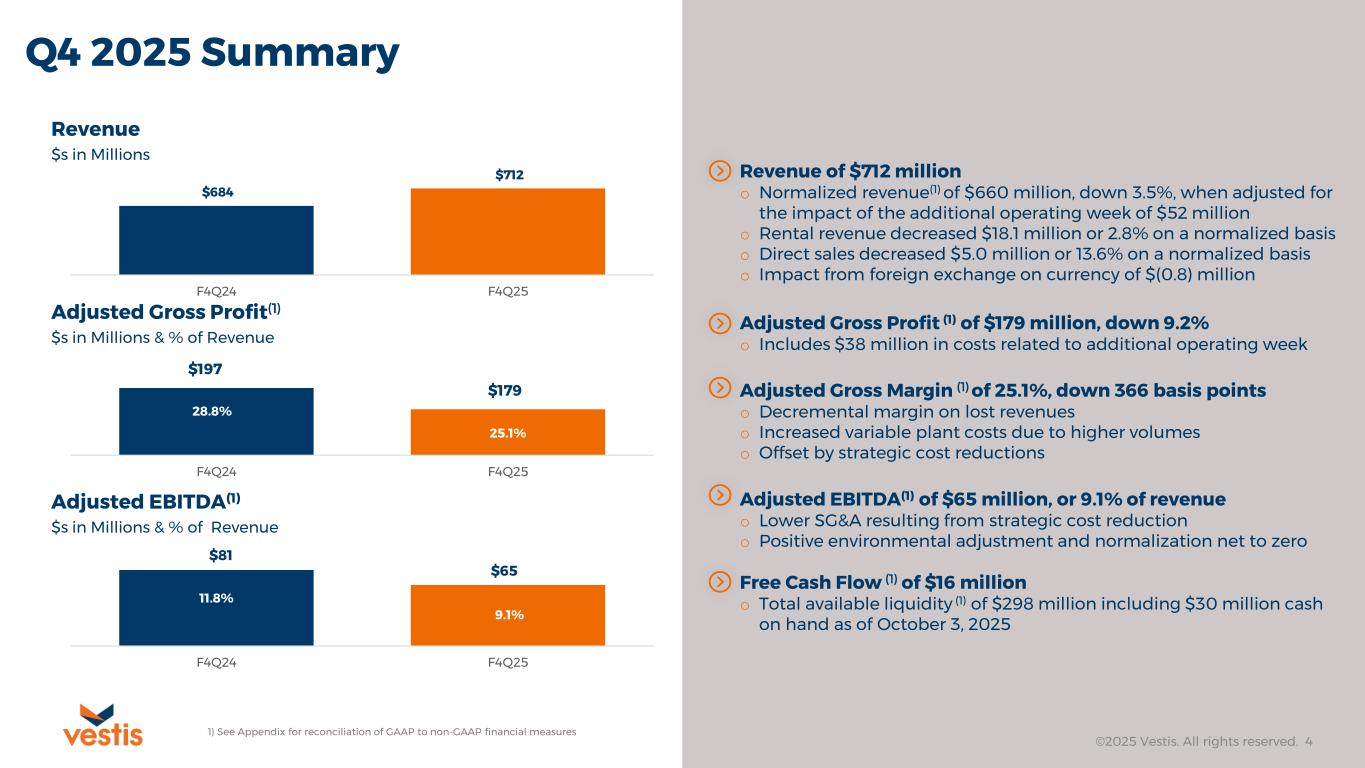

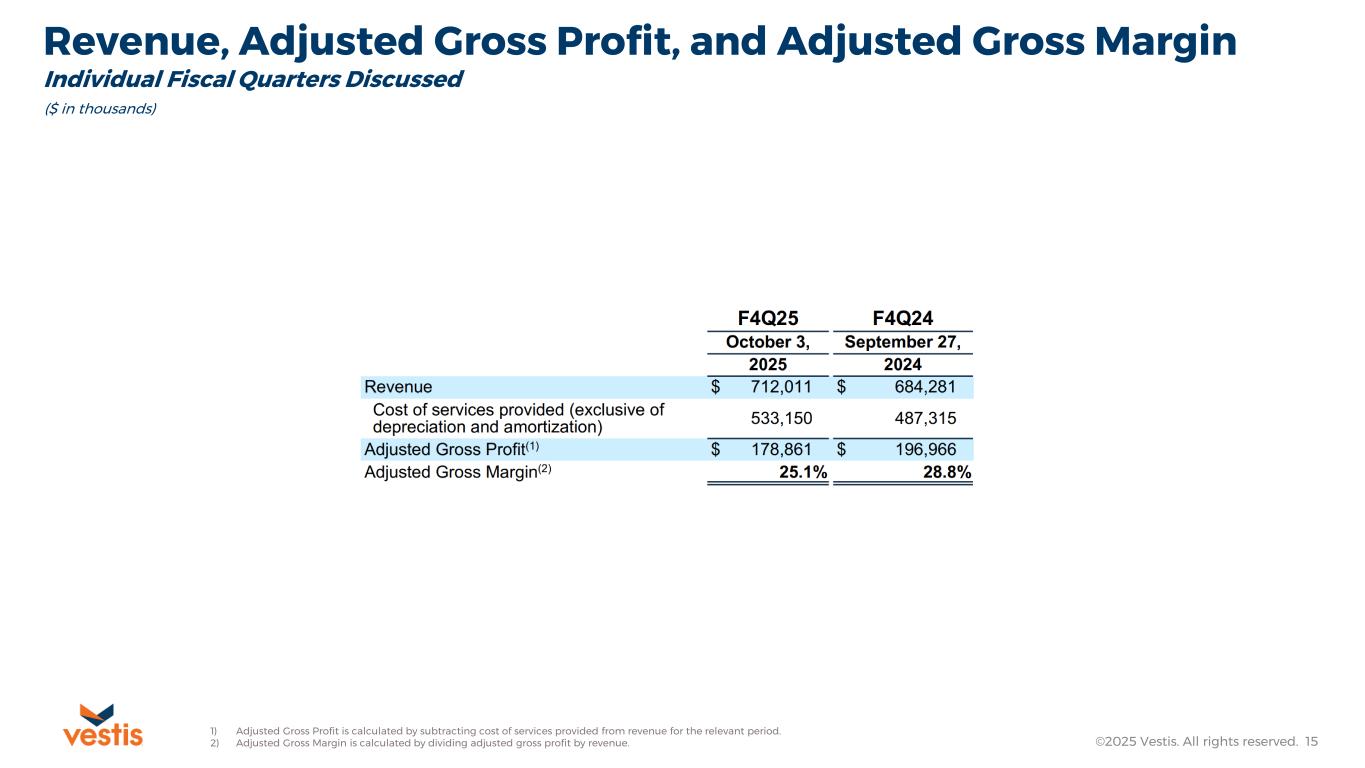

Q4 2025 Summary ©2025 Vestis. All rights reserved. 4 Revenue $s in Millions Adjusted Gross Profit(1) $s in Millions & % of Revenue Adjusted EBITDA(1) $s in Millions & % of Revenue Revenue of $712 million o Normalized revenue(1) of $660 million, down 3.5%, when adjusted for the impact of the additional operating week of $52 million o Rental revenue decreased $18.1 million or 2.8% on a normalized basis o Direct sales decreased $5.0 million or 13.6% on a normalized basis o Impact from foreign exchange on currency of $(0.8) million 1) See Appendix for reconciliation of GAAP to non-GAAP financial measures Adjusted Gross Margin (1) of 25.1%, down 366 basis points o Decremental margin on lost revenues o Increased variable plant costs due to higher volumes o Offset by strategic cost reductions Adjusted EBITDA(1) of $65 million, or 9.1% of revenue o Lower SG&A resulting from strategic cost reduction o Positive environmental adjustment and normalization net to zero Free Cash Flow (1) of $16 million o Total available liquidity (1) of $298 million including $30 million cash on hand as of October 3, 2025 $197 $179 28.8% 25.1% F4Q24 F4Q25 $81 $65 11.8% 9.1% F4Q24 F4Q25 $684 $712 F4Q24 F4Q25 Adjusted Gross Profit (1) of $179 million, down 9.2% o Includes $38 million in costs related to additional operating week

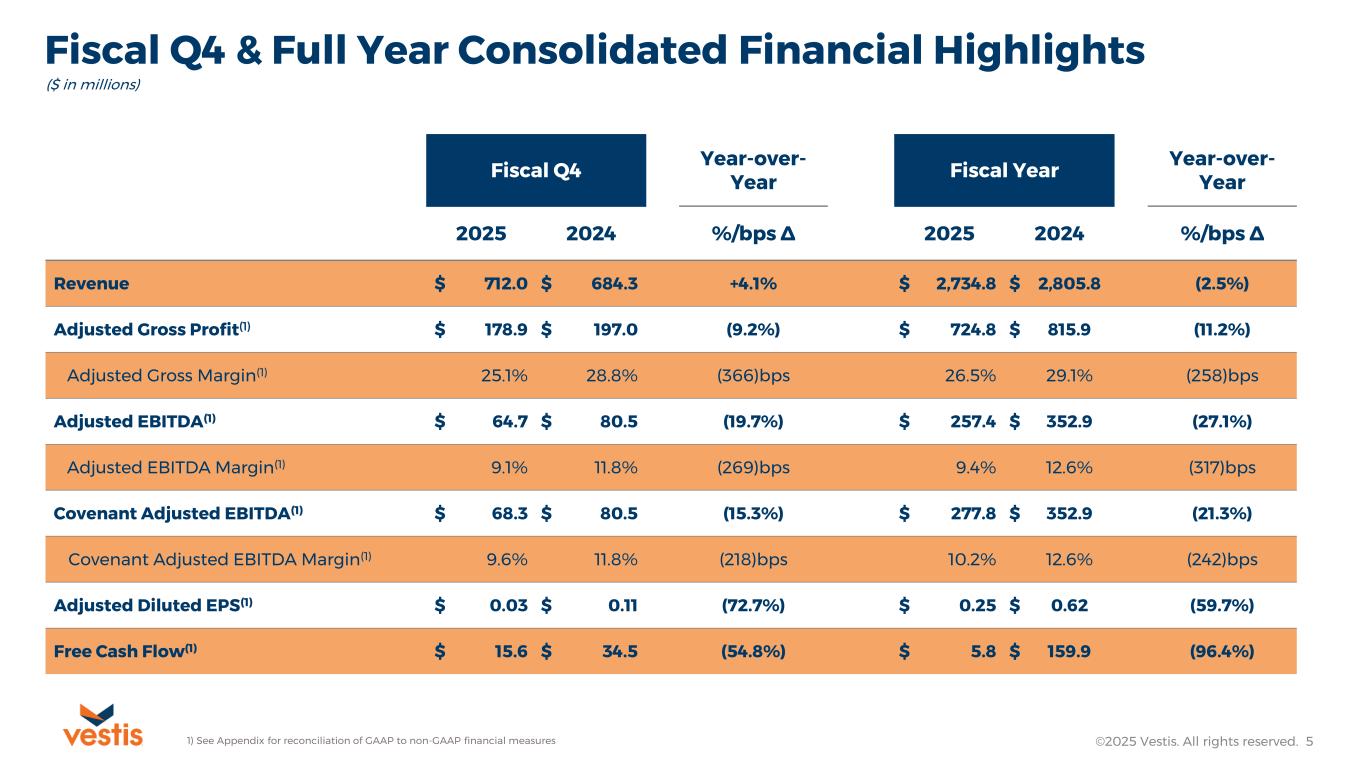

Fiscal Q4 & Full Year Consolidated Financial Highlights ©2025 Vestis. All rights reserved. 5 Fiscal Q4 Year-over- Year Fiscal Year Year-over- Year 2025 2024 %/bps ∆ 2025 2024 %/bps ∆ Revenue $ 712.0 $ 684.3 +4.1% $ 2,734.8 $ 2,805.8 (2.5%) Adjusted Gross Profit(1) $ 178.9 $ 197.0 (9.2%) $ 724.8 $ 815.9 (11.2%) Adjusted Gross Margin(1) 25.1% 28.8% (366)bps 26.5% 29.1% (258)bps Adjusted EBITDA(1) $ 64.7 $ 80.5 (19.7%) $ 257.4 $ 352.9 (27.1%) Adjusted EBITDA Margin(1) 9.1% 11.8% (269)bps 9.4% 12.6% (317)bps Covenant Adjusted EBITDA(1) $ 68.3 $ 80.5 (15.3%) $ 277.8 $ 352.9 (21.3%) Covenant Adjusted EBITDA Margin(1) 9.6% 11.8% (218)bps 10.2% 12.6% (242)bps Adjusted Diluted EPS(1) $ 0.03 $ 0.11 (72.7%) $ 0.25 $ 0.62 (59.7%) Free Cash Flow(1) $ 15.6 $ 34.5 (54.8%) $ 5.8 $ 159.9 (96.4%) 1) See Appendix for reconciliation of GAAP to non-GAAP financial measures ($ in millions)

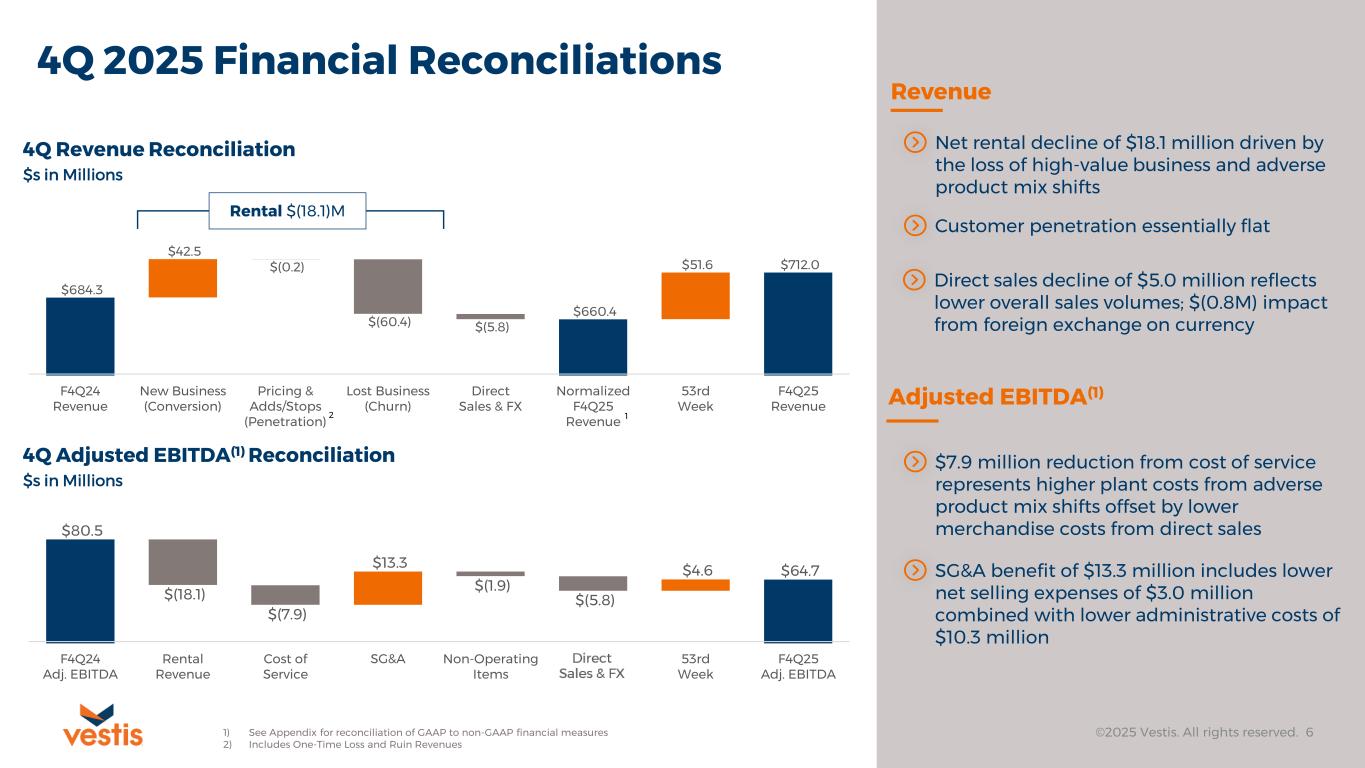

$684.3 $42.5 $(0.2) $(60.4) $(5.8) $660.4 $51.6 $712.0 F4Q24 Revenue New Business (Conversion) Pricing & Adds/Stops (Penetration) Lost Business (Churn) Direct Sales & FX Normalized F4Q25 Revenue 53rd Week F4Q25 Revenue 4Q 2025 Financial Reconciliations ©2025 Vestis. All rights reserved. 6 Net rental decline of $18.1 million driven by the loss of high-value business and adverse product mix shifts Rental $(18.1)M 4Q Revenue Reconciliation $s in Millions 4Q Adjusted EBITDA(1) Reconciliation $s in Millions Customer penetration essentially flat Direct sales decline of $5.0 million reflects lower overall sales volumes; $(0.8M) impact from foreign exchange on currency $7.9 million reduction from cost of service represents higher plant costs from adverse product mix shifts offset by lower merchandise costs from direct sales SG&A benefit of $13.3 million includes lower net selling expenses of $3.0 million combined with lower administrative costs of $10.3 million Adjusted EBITDA(1) Revenue 1) See Appendix for reconciliation of GAAP to non-GAAP financial measures 2) Includes One-Time Loss and Ruin Revenues 2 1 $80.5 $(18.1) $(7.9) $13.3 $(1.9) $(5.8) $4.6 $64.7 F4Q24 Adj. EBITDA Rental Revenue Cost of Service SG&A Non-Operating Items Direct Sales, FX & Other 53rd Week F4Q25 Adj. EBITDA

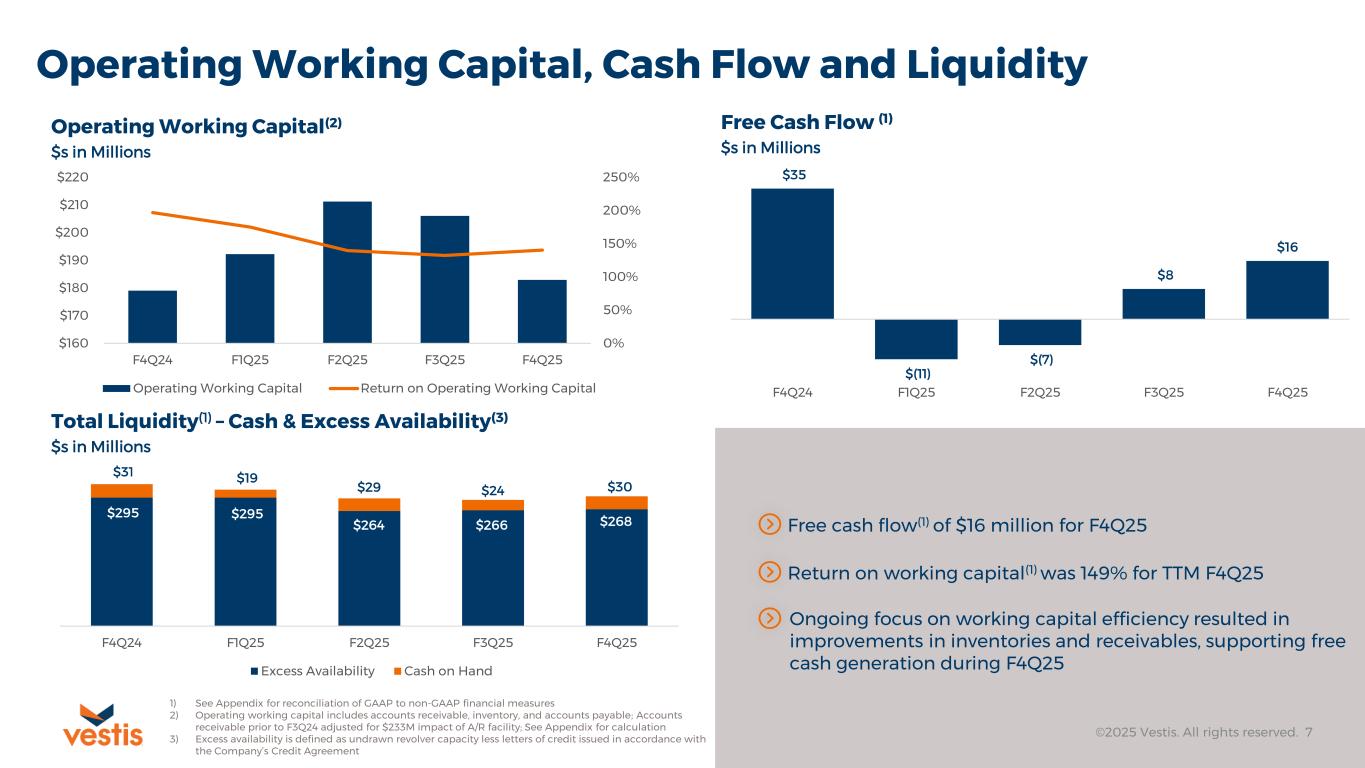

Operating Working Capital, Cash Flow and Liquidity ©2025 Vestis. All rights reserved. 7 Operating Working Capital(2) $s in Millions Total Liquidity(1) – Cash & Excess Availability(3) $s in Millions Free Cash Flow (1) $s in Millions Ongoing focus on working capital efficiency resulted in improvements in inventories and receivables, supporting free cash generation during F4Q25 Return on working capital(1) was 149% for TTM F4Q25 1) See Appendix for reconciliation of GAAP to non-GAAP financial measures 2) Operating working capital includes accounts receivable, inventory, and accounts payable; Accounts receivable prior to F3Q24 adjusted for $233M impact of A/R facility; See Appendix for calculation 3) Excess availability is defined as undrawn revolver capacity less letters of credit issued in accordance with the Company’s Credit Agreement 0% 50% 100% 150% 200% 250% $160 $170 $180 $190 $200 $210 $220 F4Q24 F1Q25 F2Q25 F3Q25 F4Q25 Operating Working Capital Return on Operating Working Capital $31 $19 $29 $24 $30 F4Q24 F1Q25 F2Q25 F3Q25 F4Q25 Excess Availability Cash on Hand $35 $(11) $(7) $8 $16 F4Q24 F1Q25 F2Q25 F3Q25 F4Q25 Free cash flow(1) of $16 million for F4Q25$268$266$264 $295$295

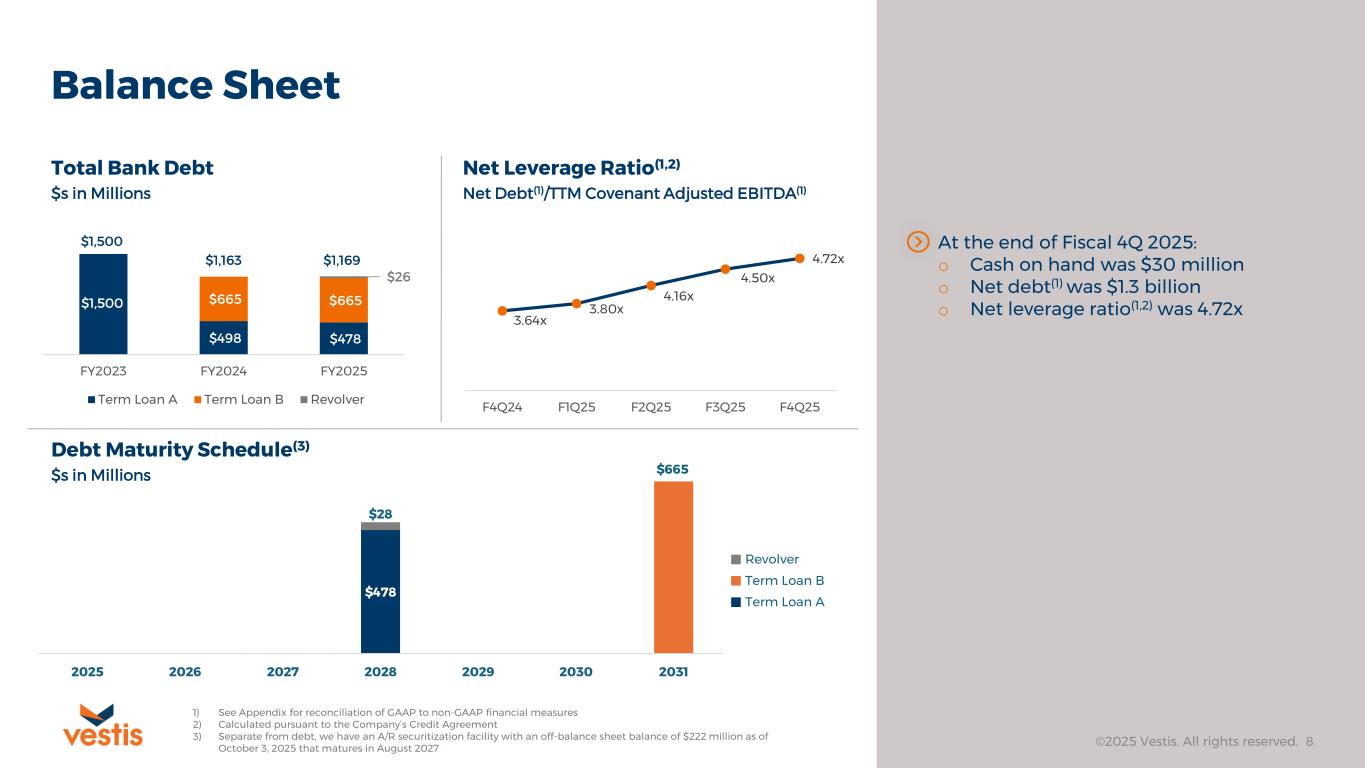

Balance Sheet ©2025 Vestis. All rights reserved. 8 Total Bank Debt $s in Millions Debt Maturity Schedule(3) $s in Millions Net Leverage Ratio(1,2) Net Debt(1)/TTM Covenant Adjusted EBITDA(1) $478 $665 $28 $222 2025 2026 2027 2028 2029 2030 2031 A/R Facility Revolver Term Loan B Term Loan A 1) See Appendix for reconciliation of GAAP to non-GAAP financial measures 2) Calculated pursuant to the Company’s Credit Agreement 3) Separate from debt, we have an A/R securitization facility with an off-balance sheet balance of $222 million as of October 3, 2025 that matures in August 2027 At the end of Fiscal 4Q 2025: o Cash on hand was $30 million o Net debt(1) was $1.3 billion o Net leverage ratio(1,2) was 4.72x$1,500 $498 $478 $665 $665 $26 FY2023 FY2024 FY2025 Term Loan A Term Loan B Revolver $1,500 $1,163 $1,169 3.64x 3.80x 4.16x 4.50x 4.72x F4Q24 F1Q25 F2Q25 F3Q25 F4Q25

Strategic Multi-Year Business Transformation Plan Commercial Excellence Operational Excellence Asset & Network Optimization Improve Operating LeverageStabilize & Grow Revenue Align Footprint For Growth Enhance customer retention, penetration and profitability through improved segmentation Strategic pricing and expanded product offerings Disciplined commercial execution with a relentless focus on serving customers Standardizing operations across facilities to boost efficiency, scalability, and cost effectiveness Streamlined organization structure aligning resources with strategic goals Focus on culture prioritizing training, succession planning, and employee engagement Deploying tools to evaluate asset and network efficiency Annual cost savings of at least $75 million by end of FY 2026 Improving logistics and asset utilization through network rationalization Consolidating and monetizing underutilized locations ©2025 Vestis. All rights reserved. 9

©2025 Vestis. All rights reserved. 10 Q&A

Appendix ©2025 Vestis. All rights reserved. 11

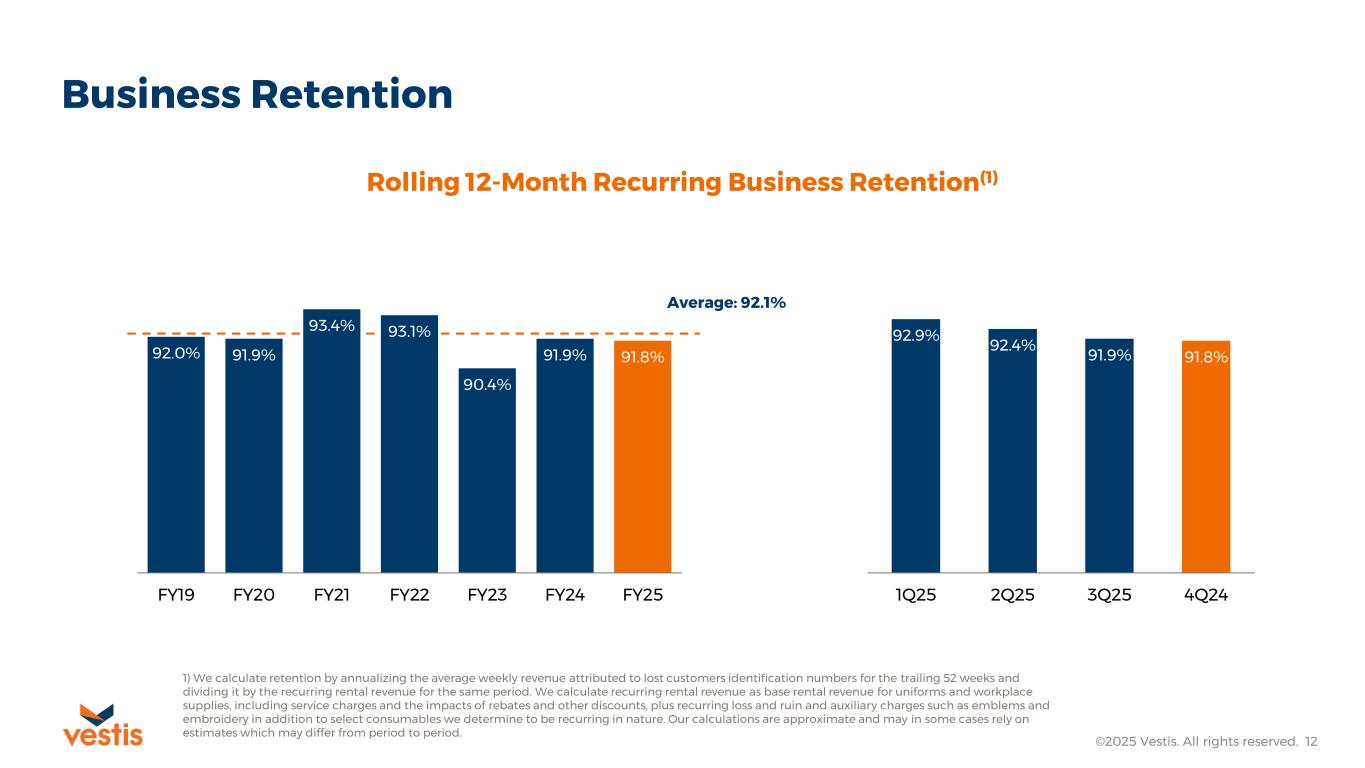

Business Retention ©2025 Vestis. All rights reserved. 12 92.0% 91.9% 93.4% 93.1% 90.4% 91.9% 91.8% FY19 FY20 FY21 FY22 FY23 FY24 FY25 Rolling 12-Month Recurring Business Retention(1) 92.9% 92.4% 91.9% 91.8% 1Q25 2Q25 3Q25 4Q24 Average: 92.1% 1) We calculate retention by annualizing the average weekly revenue attributed to lost customers identification numbers for the trailing 52 weeks and dividing it by the recurring rental revenue for the same period. We calculate recurring rental revenue as base rental revenue for uniforms and workplace supplies, including service charges and the impacts of rebates and other discounts, plus recurring loss and ruin and auxiliary charges such as emblems and embroidery in addition to select consumables we determine to be recurring in nature. Our calculations are approximate and may in some cases rely on estimates which may differ from period to period.

Non-GAAP Definitions ©2025 Vestis. All rights reserved. 13 Vestis reports its financial results in accordance with U.S. GAAP, but in this presentation and the non-GAAP reconciliations that follow, Vestis also uses the following non-GAAP measures: Normalized Revenue, Adjusted EPS, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Liquidity, Net Debt, Net Leverage Ratio, Trailing Twelve Months Covenant Adjusted EBITDA, and Return on Working Capital. Vestis believes that non-GAAP financial measures, both together with and in addition to the corresponding U.S. GAAP financial measure, are important supplemental measures that exclude non-cash or other items that may not be indicative of or are unrelated to Vestis’ core operating results. Vestis uses these non-GAAP financial measures with U.S. GAAP financial measures and other comparable tools to assist in the evaluation of its operating performance. Vestis believes that presentation of these measures also helps investors because the measures enable better comparisons of Vestis’ historical results and allow investors to evaluate Vestis’ performance based on the same metrics that Vestis uses to evaluate its performance and trends in its results. However, these measures have limitations as analytical tools and should not be considered in isolation or as a substitute for Vestis’ results as reported under U.S. GAAP. Specifically, you should not consider these measures as alternatives to revenue, operating income, operating income margin, net income, net income margin or net cash provided by operating activities determined in accordance with U.S. GAAP. These non-GAAP financial measures also should not be considered as measures of cash available to Vestis to invest in the growth of Vestis’ business or cash that will be available to Vestis to meet its obligations. Non-GAAP financial measures as presented by Vestis may not be comparable to other similarly titled measures of other companies because not all companies use identical calculations. These non-GAAP measures are reconciled in the tables at the end of this presentation. Normalized Revenue Normalized Revenue removes the impact of the 53rd week in fiscal 2025 to facilitate comparability with prior 52-week years and prior 13-week quarters. Normalized Revenue is calculated by taking reported revenue and subtracting the estimated revenue associated with the additional operating week. The estimated one-week revenue impact is determined by dividing total reported revenue by 53 weeks to derive an average weekly revenue amount. Adjusted EPS Adjusted EPS represents Net Income or Loss adjusted for share-based compensation expense; severance; separation related charges; securitization fees; loss (gain) on sale of equity investment; third party debt amendment fees; legal reserves and settlements; gains, losses, and other items impacting comparability divided by basic and diluted weighted average shares outstanding. Adjusted Gross Profit Adjusted Gross Profit is defined as Total Revenue minus Cost of Services Provided (exclusive of depreciation and amortization). Adjusted Gross Margin Adjusted Gross Profit Margin is defined as Adjusted Gross Profit divided by Total Revenue. Adjusted EBITDA Adjusted EBITDA represents net income adjusted for provision for income taxes; interest expense, net; and depreciation and amortization (EBITDA), further adjusted for share-based compensation expense; severance; separation related charges; securitization fees; loss (gain) on sale of equity investment; third party debt amendment fees; legal reserves and settlements; gains, losses, and other items impacting comparability. Adjusted EBITDA is presented in order to reflect Vestis’ results in a manner that allows a better understanding of operational activities separate from the financial impact of decisions made for the long-term benefit of Vestis and other items impacting comparability between periods. Similar adjustments have been recorded in Adjusted EBITDA for earlier periods and similar types of adjustments can reasonably be expected to be recorded in Adjusted EBITDA in future periods.

©2025 Vestis. All rights reserved. 14 Non-GAAP Definitions, continued Adjusted EBITDA Margin Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of Revenue Free Cash Flow Free Cash Flow represents net cash provided by operating activities adjusted for purchases of property and equipment and other. Free Cash Flow is presented because it relates the operating cash flow of Vestis to the capital that is spent to continue and improve business operations and indicates the amount of cash generated or used after capital expenditures that can be used for, among other things, investment in the Vestis business, strengthening the balance sheet, and repayment of debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Liquidity Liquidity is Excess Availability, which is defined as undrawn revolver capacity less letters of credit issued, plus Cash and Cash Equivalents. Net Leverage Ratio, Net Debt, Covenant Adjusted EBITDA, Covenant Adjusted EBITDA Margin and Trailing Twelve Months Covenant Adjusted EBITDA Net Leverage Ratio is defined in Vestis’ credit agreement and is calculated as consolidated total indebtedness in excess of unrestricted cash (referred to herein as “Net Debt”), divided by the Trailing Twelve Months Covenant Adjusted EBITDA. Net Debt represents total principal debt outstanding, letters of credit outstanding, and finance lease obligations, less cash and cash equivalents. Covenant Adjusted EBITDA represents Adjusted EBITDA, as further modified by certain items specifically permitted under the credit agreement to assess compliance with its financial covenants. Covenant Adjusted EBITDA Margin is Covenant Adjusted EBITDA as a percentage of Revenue. Trailing Twelve Months Covenant Adjusted EBITDA represents Covenant Adjusted EBITDA for the preceding four fiscal quarters. Vestis believes that Net Leverage Ratio and its components are useful to investors because they are indicators of Vestis’ ability to meet its future financial obligations and are measures that are frequently used by investors and creditors. Return on Working Capital Return on working capital is calculated by dividing trailing twelve months Adjusted EBITDA with operating working capital. Forward Looking Non-GAAP Information This presentation also includes certain non-GAAP financial information that is forward-looking in nature, including our expected 2026 Adjusted EBITDA and Free Cash Flow. Vestis believes that a quantitative reconciliation of such forward-looking information to the most comparable financial measure calculated and presented in accordance with GAAP cannot be made available without unreasonable efforts. A reconciliation of these non-GAAP financial measures would require Vestis to predict the timing and likelihood of among other things future acquisitions and divestitures, restructurings, asset impairments, other charges and other factors not within Vestis’ control. Neither these forward-looking measures, nor their probable significance, can be quantified with a reasonable degree of accuracy. Accordingly, the most directly comparable forward-looking GAAP measures are not provided. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

Revenue, Adjusted Gross Profit, and Adjusted Gross Margin Individual Fiscal Quarters Discussed ©2025 Vestis. All rights reserved. 15 ($ in thousands) 1) Adjusted Gross Profit is calculated by subtracting cost of services provided from revenue for the relevant period. 2) Adjusted Gross Margin is calculated by dividing adjusted gross profit by revenue.

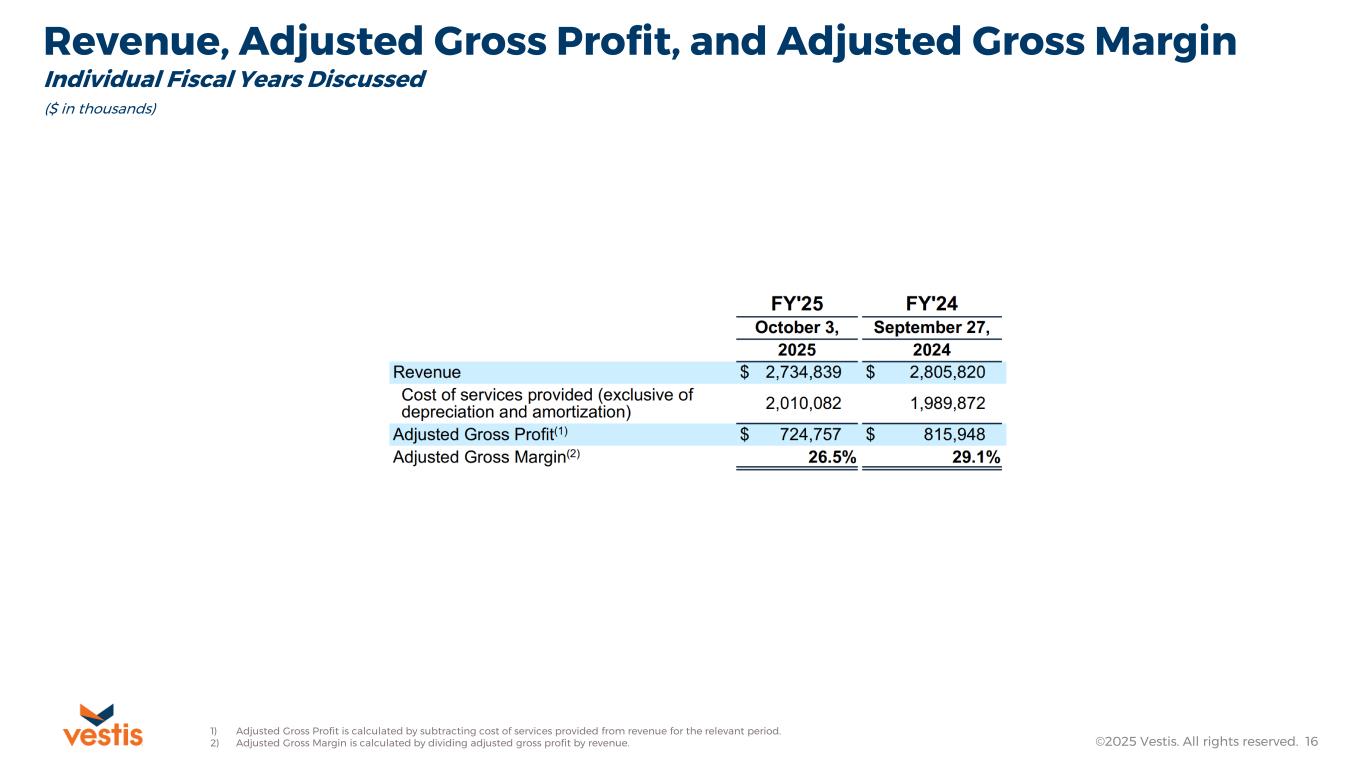

Revenue, Adjusted Gross Profit, and Adjusted Gross Margin Individual Fiscal Years Discussed ©2025 Vestis. All rights reserved. 16 ($ in thousands) 1) Adjusted Gross Profit is calculated by subtracting cost of services provided from revenue for the relevant period. 2) Adjusted Gross Margin is calculated by dividing adjusted gross profit by revenue.

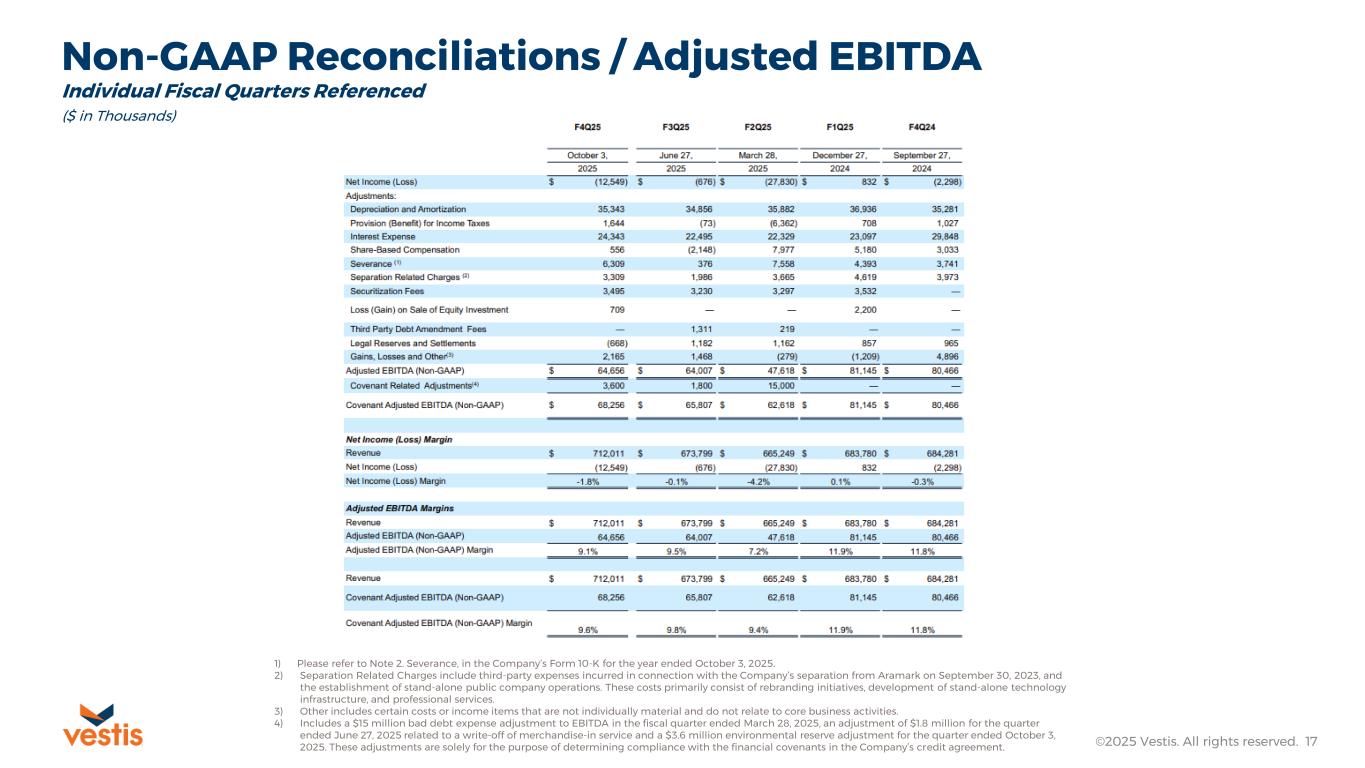

Non-GAAP Reconciliations / Adjusted EBITDA ©2025 Vestis. All rights reserved. 17 ($ in Thousands) 1) Please refer to Note 2. Severance, in the Company’s Form 10-K for the year ended October 3, 2025. 2) Separation Related Charges include third-party expenses incurred in connection with the Company’s separation from Aramark on September 30, 2023, and the establishment of stand-alone public company operations. These costs primarily consist of rebranding initiatives, development of stand-alone technology infrastructure, and professional services. 3) Other includes certain costs or income items that are not individually material and do not relate to core business activities. 4) Includes a $15 million bad debt expense adjustment to EBITDA in the fiscal quarter ended March 28, 2025, an adjustment of $1.8 million for the quarter ended June 27, 2025 related to a write-off of merchandise-in service and a $3.6 million environmental reserve adjustment for the quarter ended October 3, 2025. These adjustments are solely for the purpose of determining compliance with the financial covenants in the Company’s credit agreement. Individual Fiscal Quarters Referenced

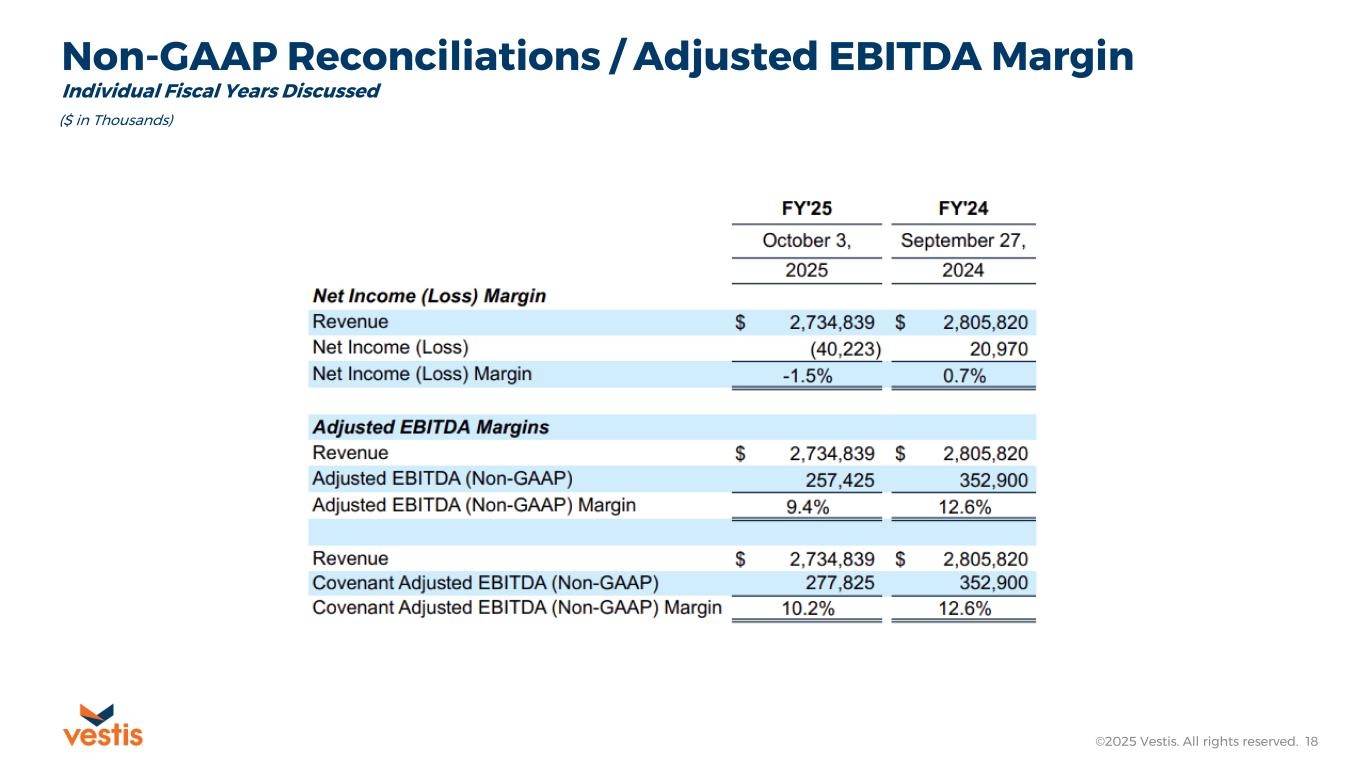

Non-GAAP Reconciliations / Adjusted EBITDA Margin ©2025 Vestis. All rights reserved. 18 ($ in Thousands) Individual Fiscal Years Discussed

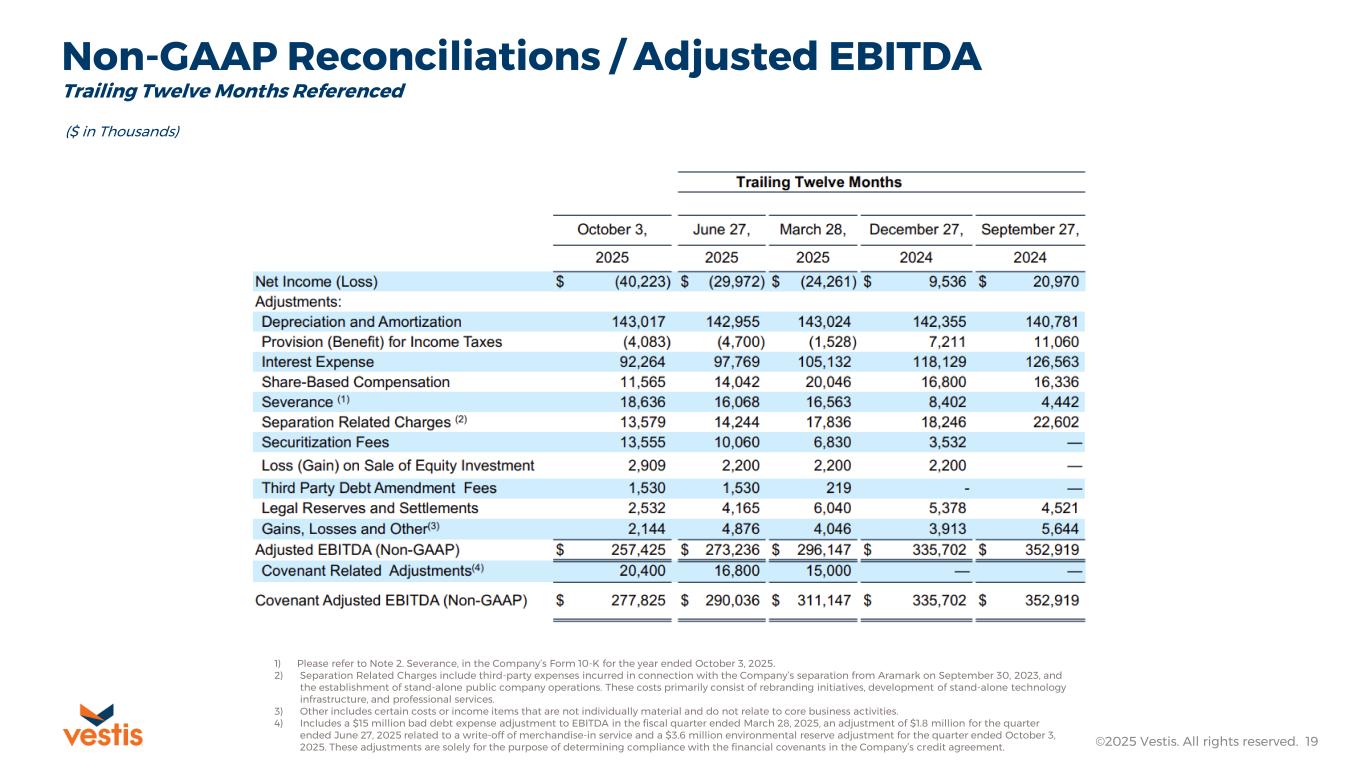

Non-GAAP Reconciliations / Adjusted EBITDA ©2025 Vestis. All rights reserved. 19 ($ in Thousands) Trailing Twelve Months Referenced 1) Please refer to Note 2. Severance, in the Company’s Form 10-K for the year ended October 3, 2025. 2) Separation Related Charges include third-party expenses incurred in connection with the Company’s separation from Aramark on September 30, 2023, and the establishment of stand-alone public company operations. These costs primarily consist of rebranding initiatives, development of stand-alone technology infrastructure, and professional services. 3) Other includes certain costs or income items that are not individually material and do not relate to core business activities. 4) Includes a $15 million bad debt expense adjustment to EBITDA in the fiscal quarter ended March 28, 2025, an adjustment of $1.8 million for the quarter ended June 27, 2025 related to a write-off of merchandise-in service and a $3.6 million environmental reserve adjustment for the quarter ended October 3, 2025. These adjustments are solely for the purpose of determining compliance with the financial covenants in the Company’s credit agreement.

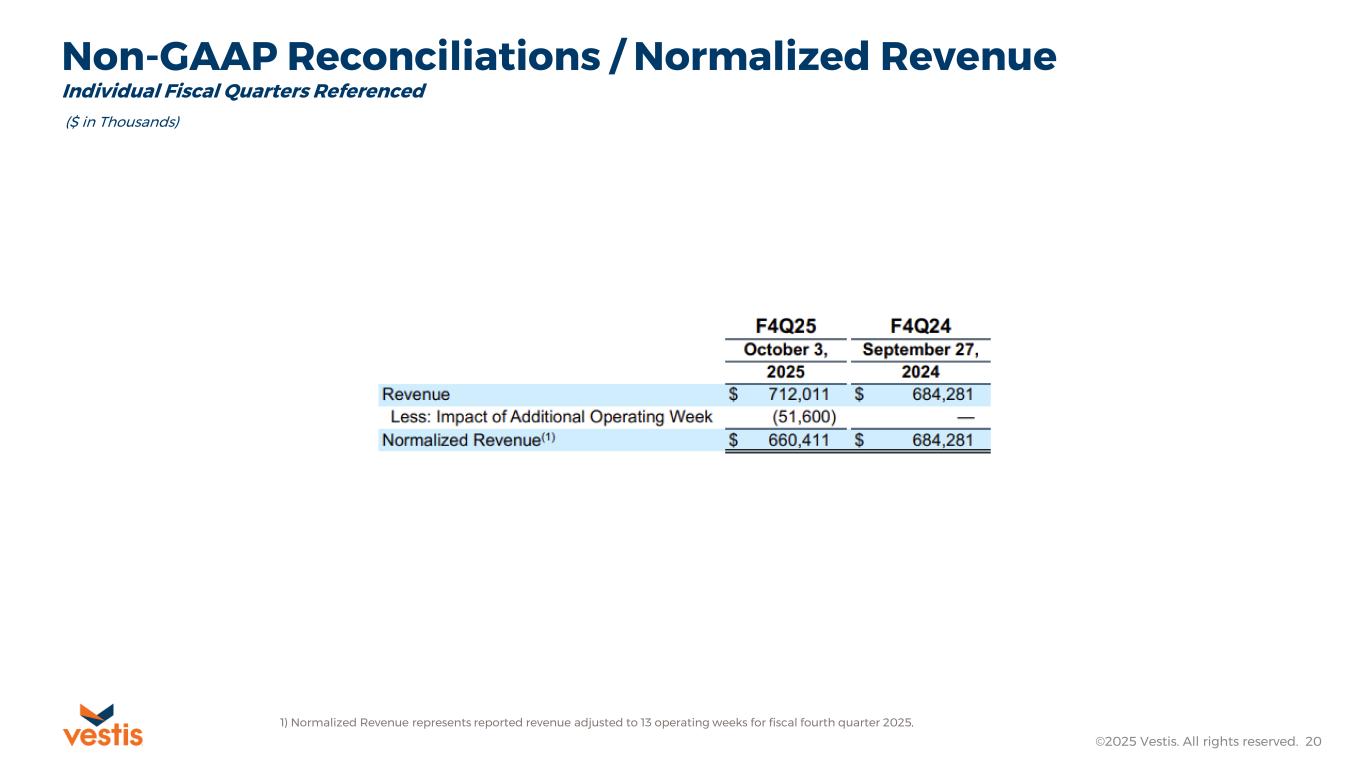

Non-GAAP Reconciliations / Normalized Revenue ©2025 Vestis. All rights reserved. 20 ($ in Thousands) Individual Fiscal Quarters Referenced 1) Normalized Revenue represents reported revenue adjusted to 13 operating weeks for fiscal fourth quarter 2025.

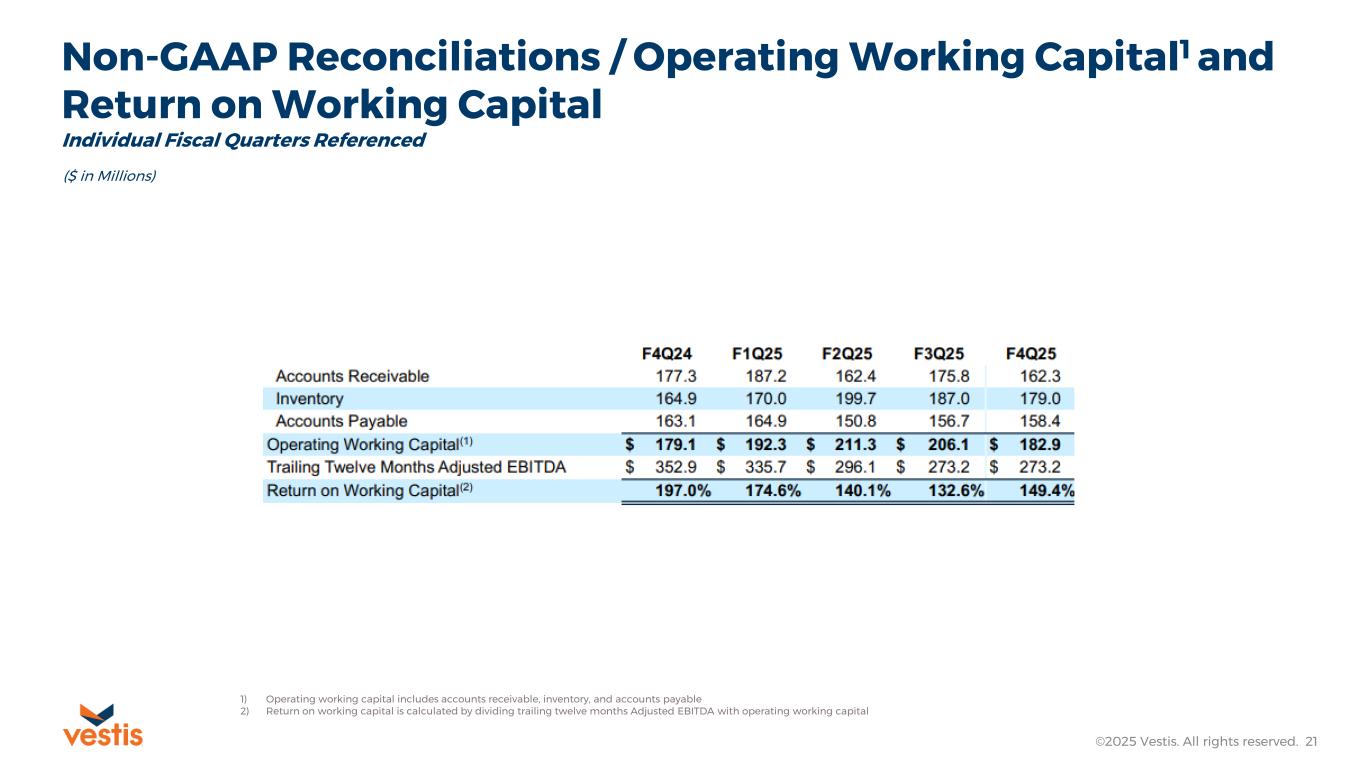

Non-GAAP Reconciliations / Operating Working Capital1 and Return on Working Capital Individual Fiscal Quarters Referenced ©2025 Vestis. All rights reserved. 21 ($ in Millions) 1) Operating working capital includes accounts receivable, inventory, and accounts payable 2) Return on working capital is calculated by dividing trailing twelve months Adjusted EBITDA with operating working capital

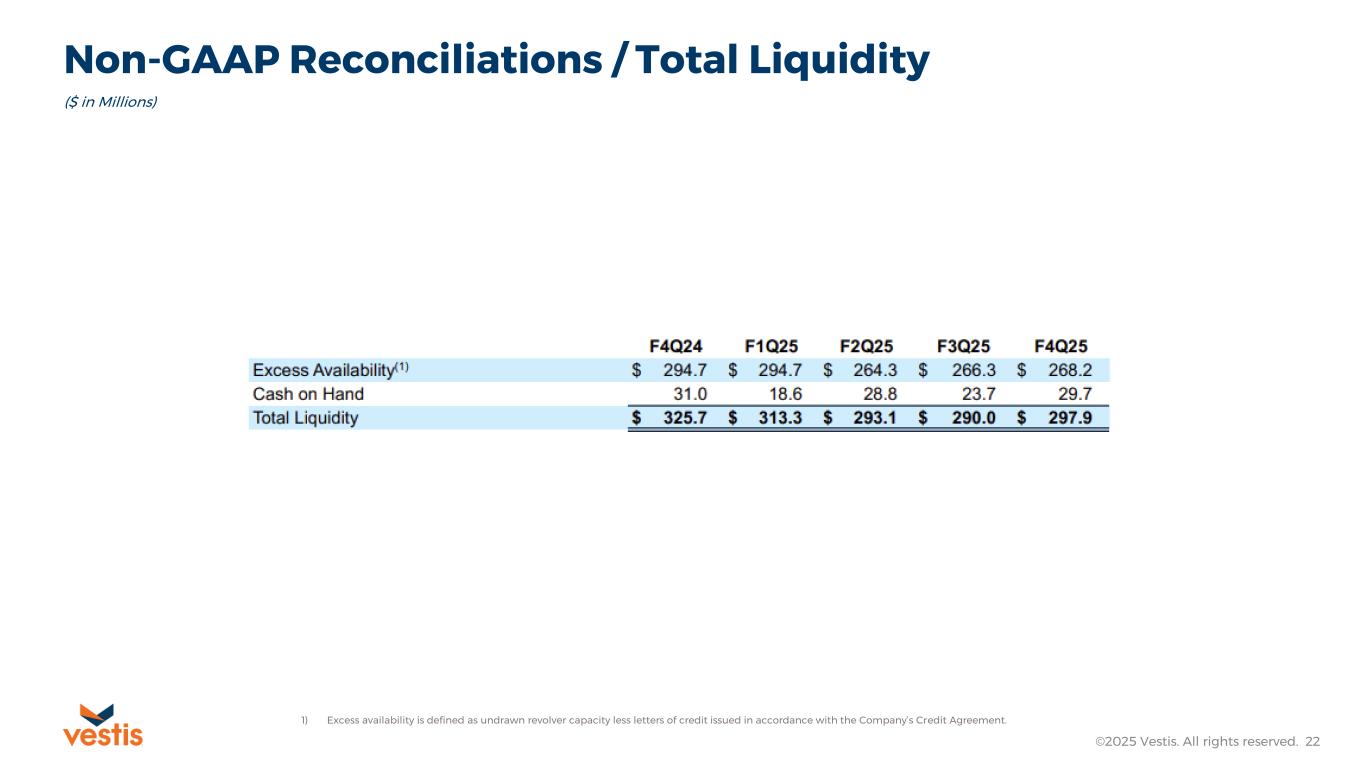

Non-GAAP Reconciliations / Total Liquidity ©2025 Vestis. All rights reserved. 22 ($ in Millions) 1) Excess availability is defined as undrawn revolver capacity less letters of credit issued in accordance with the Company’s Credit Agreement.

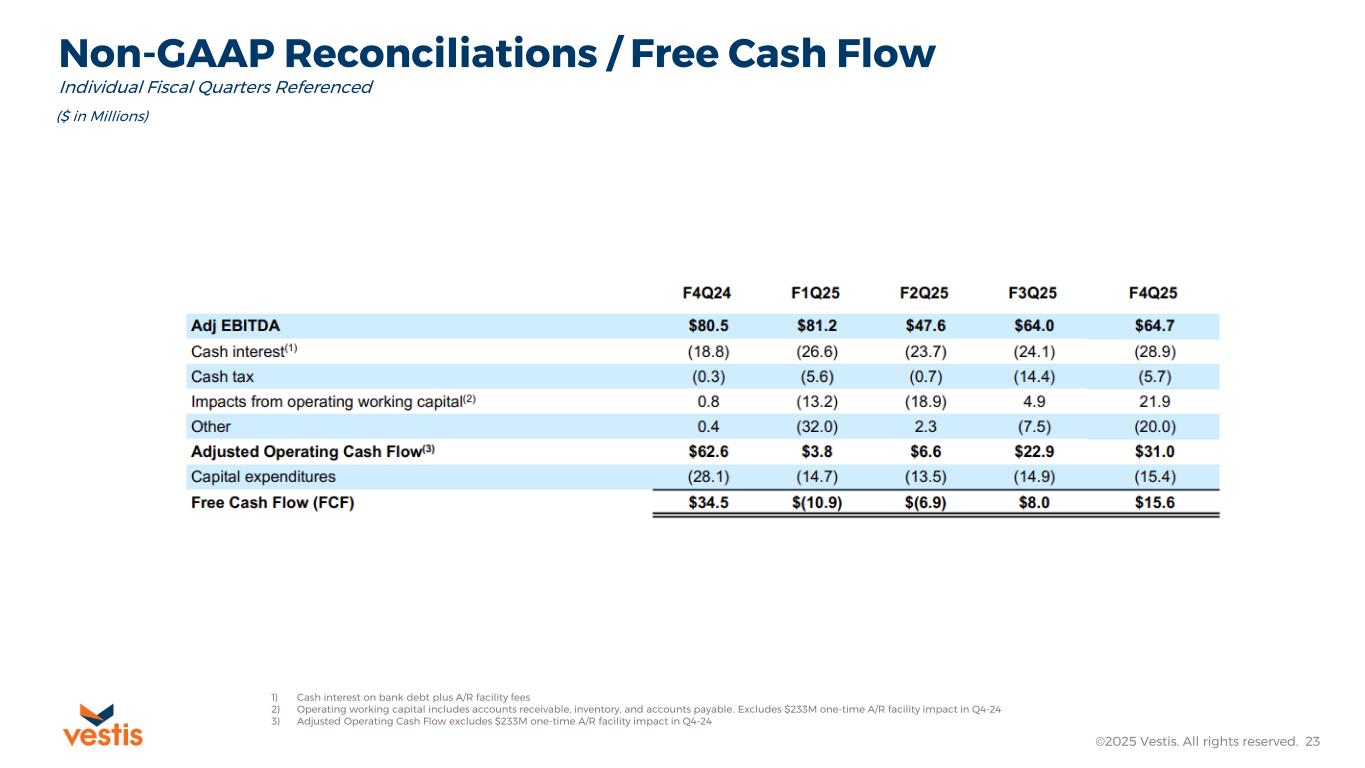

Non-GAAP Reconciliations / Free Cash Flow ©2025 Vestis. All rights reserved. 23 ($ in Millions) 1) Cash interest on bank debt plus A/R facility fees 2) Operating working capital includes accounts receivable, inventory, and accounts payable. Excludes $233M one-time A/R facility impact in Q4-24 3) Adjusted Operating Cash Flow excludes $233M one-time A/R facility impact in Q4-24 Individual Fiscal Quarters Referenced

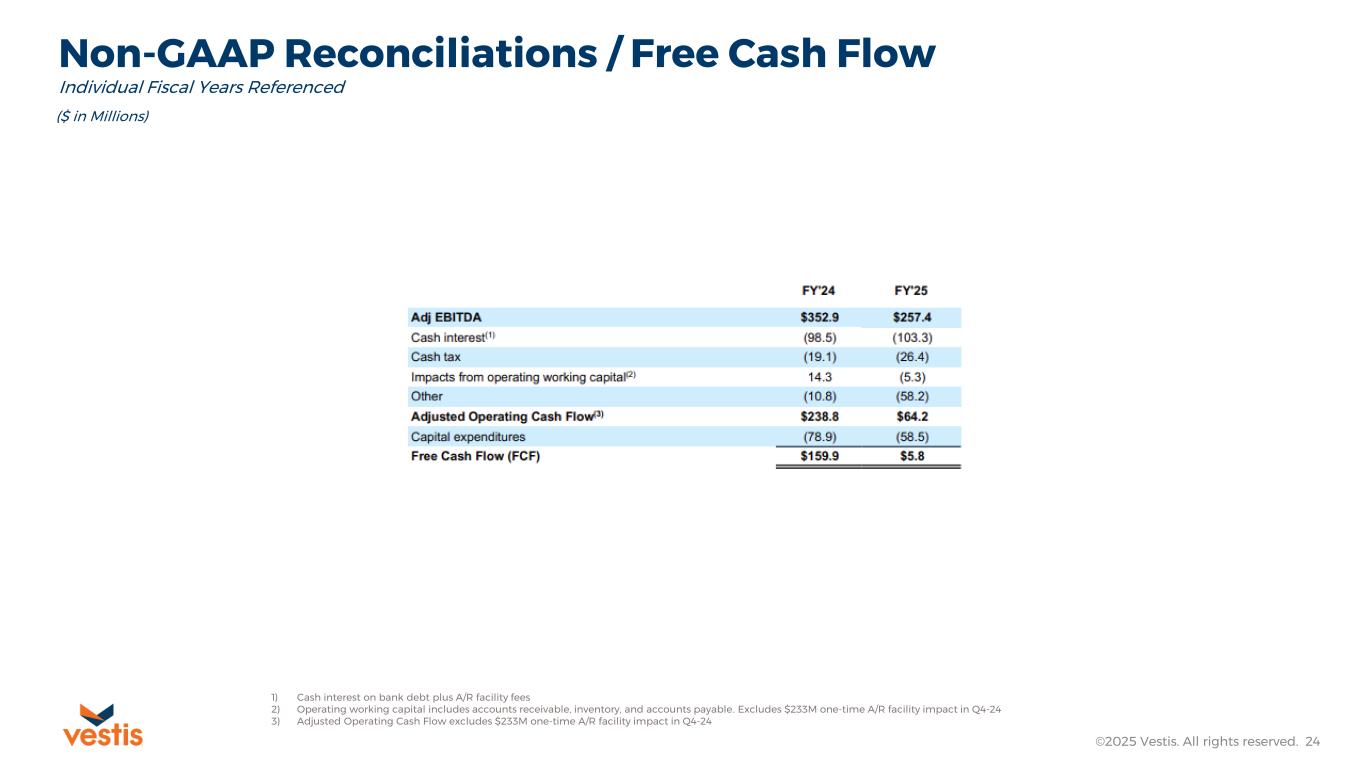

Non-GAAP Reconciliations / Free Cash Flow ©2025 Vestis. All rights reserved. 24 ($ in Millions) 1) Cash interest on bank debt plus A/R facility fees 2) Operating working capital includes accounts receivable, inventory, and accounts payable. Excludes $233M one-time A/R facility impact in Q4-24 3) Adjusted Operating Cash Flow excludes $233M one-time A/R facility impact in Q4-24 Individual Fiscal Years Referenced

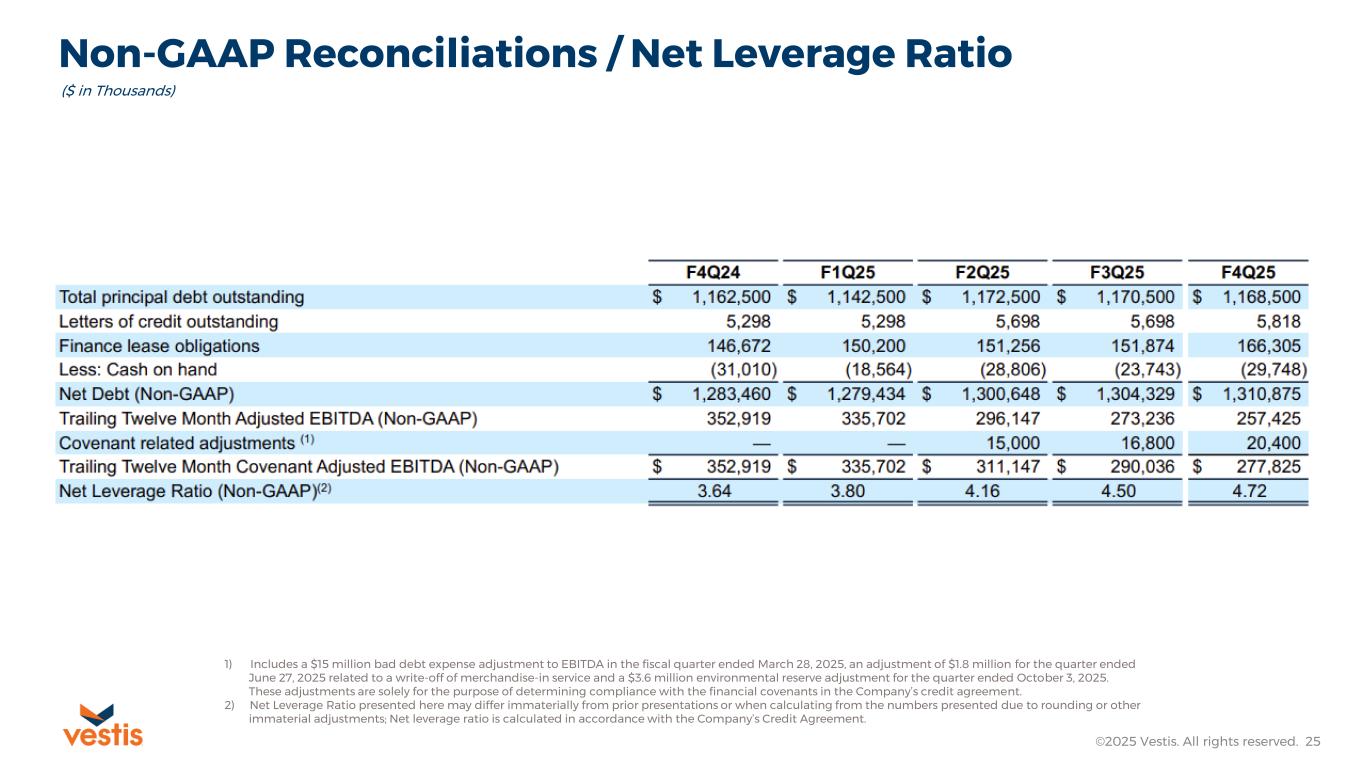

Non-GAAP Reconciliations / Net Leverage Ratio ©2025 Vestis. All rights reserved. 25 ($ in Thousands) 1) Includes a $15 million bad debt expense adjustment to EBITDA in the fiscal quarter ended March 28, 2025, an adjustment of $1.8 million for the quarter ended June 27, 2025 related to a write-off of merchandise-in service and a $3.6 million environmental reserve adjustment for the quarter ended October 3, 2025. These adjustments are solely for the purpose of determining compliance with the financial covenants in the Company’s credit agreement. 2) Net Leverage Ratio presented here may differ immaterially from prior presentations or when calculating from the numbers presented due to rounding or other immaterial adjustments; Net leverage ratio is calculated in accordance with the Company’s Credit Agreement.

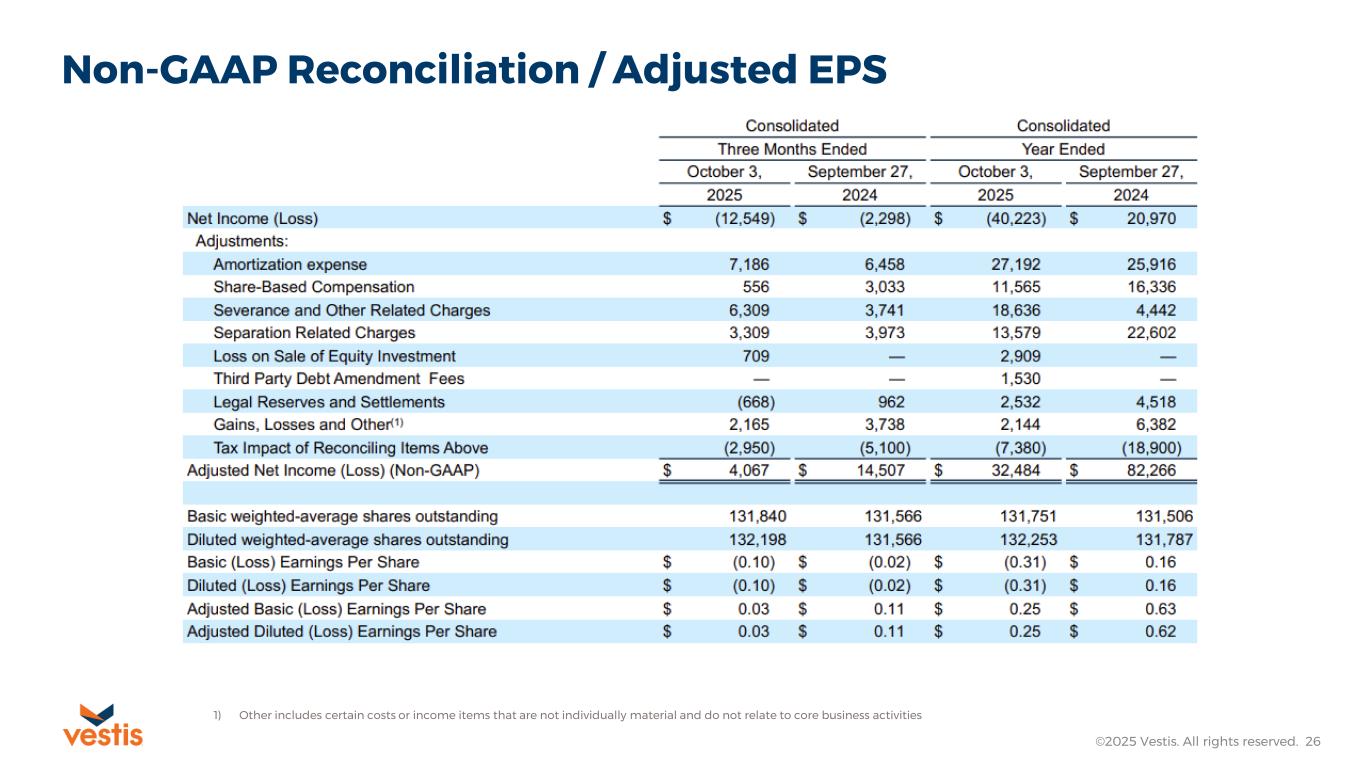

Non-GAAP Reconciliation / Adjusted EPS ©2025 Vestis. All rights reserved. 26 1) Other includes certain costs or income items that are not individually material and do not relate to core business activities

©2025 Vestis. All rights reserved. 27