EX-19.1

Published on November 22, 2024

765324966 1 VESTIS CORPORATION SECURITIES TRADING POLICY Set forth below is the policy of Vestis Corporation and its subsidiaries (the “Corporation”) regarding securities trading (the “Policy”). This Policy applies to all employees and directors of the Corporation and is subject to change without prior notification. Please note that this Policy supplements the restrictions set forth in the Business Conduct Policy of the Corporation and the other policies of the Corporation. Any violation of this securities trading policy may result in immediate dismissal and may subject the individual involved to both civil and criminal penalties. This is an extremely important matter, and we urge you to read the following with care. This Policy is divided into two parts, Section I sets forth the trading restrictions and policies that apply to each member of the Corporation’s Board of Directors (the “Board”) and each of the Corporation’s employees, as well as his or her respective spouse, minor children and any other family members having the same home as him or her (“Immediate Family”), as well as, unless an exemption is specifically authorized by the Board, any other account for which he or she makes or influences investment decisions, such as an account for a member of his or her family who consults him or her about investment decisions or a trust account or other account as to which he or she has investment authority (“Controlled Accounts”). Section II contains additional trading restrictions applicable to the Board, executive officers and certain other designated employees (the “Designated Employees”). From time to time, certain other employees may be designated as “Designated Employees” due to their position, responsibilities or their actual or potential access to material information. This Policy continues in effect until the opening of the first Window Period (as defined below) after termination of employment or other relationship with the Corporation, except that the pre-clearance requirements set forth in Section II continue to apply to directors and executive officers for up to six months after the termination of his or her status as a director or executive officer. I. Directors and All Employees 1. Prohibitions Against Trading on or Tipping Non-Public Information The federal securities laws and rules promulgated thereunder prohibit any person that is aware of material, non-public information from purchasing or selling securities and from communicating such information to any other person for such use. Material information is any information that a reasonable investor would consider important in determining whether to buy, sell or hold securities. Non-public information is information that has not been effectively disseminated to the investing public. The sole exception to this prohibition is if the purchase or sale is made pursuant to a pre- existing written plan or arrangement complying with Rule 10b5-1 promulgated under the Exhibit 19.1

765324966 2 Securities Exchange Act of 1934, as amended (the “Exchange Act”), and approved in advance by the Corporation’s Legal Department. The adoption and terms of Rule 10b5-1 trading plans must comply with all applicable rules and regulations. During the period that a person is aware of material, non-public information and absent a pre-existing written plan or arrangement pursuant to Rule 10b5-1, he or she will have to forgo a proposed transaction in the Corporation’s securities, even though he or she may have planned to make the purchase or sale before learning of the material, non-public information and even though failure to execute the purchase or sale may result in an economic loss to, or nonrealization of anticipated profit by, the person possessing such information. For additional requirements relating to Rule 10b5-1 trading plans, see Appendix A. This Policy is intended to protect the Corporation’s employees, Board members and their families, and the Corporation from insider trading violations. However, the guidance set forth in this Policy is not intended to replace your responsibility to understand and comply with the legal prohibition on insider trading. Appropriate judgment should be exercised in connection with all securities trading. If you have specific questions regarding this Policy or applicable law, please contact the persons listed at the end of this Policy. Employees and Board members may not purchase or sell securities issued by the Corporation or any other company with which the Corporation transacts business while aware of material, non-public information concerning the Corporation or such other company, respectively. It is also the Corporation’s policy that all non-public information concerning the Corporation, its clients, suppliers and competitors, which is obtained by the Corporation’s employees or the Board in the course of his or her employment or Board membership may not be communicated to any other person (including relatives, friends or business associates or in any consultant capacity and regardless of the purpose for which such communication may be made), except to the extent necessary to perform authorized work for the Corporation or as otherwise specifically permitted by law, nor should such information be discussed with any person within the Corporation under circumstances where it could be overheard. Non-public information relating to the Corporation is the property of the Corporation and the unauthorized disclosure of such information is forbidden. Written information should be appropriately safeguarded and should not be left where it may be seen by persons not entitled to the information. The unauthorized disclosure of information could result in serious consequences to the Corporation and such other companies, whether or not such disclosure is made for the purpose of facilitating improper trading in securities. In addition to other circumstances in which it may be applicable, this confidentiality policy must be strictly adhered to in responding to inquiries about the Corporation that may be made by the press, financial analysts or other members of the financial community. It is important that responses to any such inquiries be made on behalf of the Corporation by a designated person. Accordingly, neither the Board nor employees of the Corporation should respond to such inquiries unless expressly authorized to do so. Any such inquiries should be referred to the Vice President, Investor Relations. For further information about the

765324966 3 Corporation’s policy with respect to disclosure of material, non-public information, see the Corporation’s Policy on Fair Disclosure to Investors. The term “security” or “securities” is defined very broadly by the securities laws and includes: stock (common and preferred), stock options, warrants, bonds, notes, debentures, convertible instruments, put or call options (i.e., exchange-traded options), and other similar instruments. 2. Material, Non-Public Information A determination as to whether information is material or non-public depends on all of the related facts and circumstances. Information that you should consider material includes, but is not limited to: • quarterly or annual results; • guidance on earnings estimates and changing or confirming such guidance on a later date; • mergers, acquisitions, tender offers, joint ventures, or changes in assets; • new products or discoveries; • developments regarding customers or suppliers, including the acquisition or loss of an important contract; • changes in control or in senior management; • changes in compensation policy; • change in the Corporation’s independent registered public accounting firm or notification that the Corporation may no longer rely on such firm’s report; • financings and other events regarding the Corporation securities (e.g., defaults on securities, calls of securities for redemption, share repurchase plans, stock splits, public or private sales of securities, changes in dividends and changes to the rights of securityholders); • significant write-offs; • significant litigation or governmental investigations; • significant cybersecurity breaches; and • bankruptcy, corporate restructuring or receivership. In addition, it should be emphasized that material information does not have to relate to a company’s business. For example, information about the contents of a forthcoming publication in the financial press that is expected to affect the market price of a security could be material. Courts often resolve close cases in favor of finding the information material. Therefore, you should err on the side of caution and keep in mind that the Securities and Exchange Commission’s (“SEC”) rules and regulations provide that the mere fact that a person is aware of the information is a bar to trading. It is no excuse that such person’s reasons for trading were not based on the information. For the purpose of this Policy, information is “non-public” until three criteria have been satisfied:

765324966 4 First, the information must have been widely disseminated. Insiders should assume that information has NOT been widely disseminated unless one or more of the following has occurred: • it has been carried in a “financial” news service such as the Dow Jones Broad Tape; • it has been carried in a “general” news service such as the Associated Press; • it has been carried by a national television news service; or • it has appeared in a filing with the SEC. Second, the information disseminated must be some form of “official” announcement. In other words, the fact that rumors, speculation, or statements attributed to unidentified sources are public is insufficient to be considered widely disseminated even when the information is accurate. Third, after the information has been disseminated, a period of time must pass sufficient for the information to be assimilated by the general public. As a general rule, at least 24 hours (several of which must be hours during which the New York Stock Exchange is open for trading) must elapse between the dissemination of information in a national news medium and when that information may be considered public. 3. Stock Options The Corporation’s employees may exercise stock options and hold the underlying securities, notwithstanding the foregoing prohibitions, provided that the exercise price and applicable withholding tax are paid in cash. “Broker’s cashless exercises” and option exercises where securities are traded in order to pay the exercise price or withholding may only be executed when the holder is not in possession of material, nonpublic information and in accordance with any applicable restrictions under the Corporation’s equity plans. 4. Employee Stock Purchase Plan The Corporation’s employees may participate in Employee Stock Purchase Plan in effect from time to time, including any “cashless participation feature,” notwithstanding the prohibitions described herein, provided that such participation is in accordance with the Corporation’s policies and procedures in effect at such time. Note that any sale of stock acquired through such Employee Stock Purchase Plan, other than through the “cashless participation feature” is subject to this Policy. 5. Prohibition on Short-Term Trading Short-term investment activity in the Corporation’s securities, such as trading in or writing options, warrants, puts, calls or similar instruments on the Corporation’s securities or

765324966 5 selling such securities “short” (i.e., selling stock that is not owned and borrowing the shares to make delivery), arbitrage trading or “day trading,” is not appropriate under any circumstances, and accordingly is prohibited. Such activities put the personal gain of the trader in conflict with the best interests of the Corporation and its securityholders or otherwise may give the appearance of impropriety. 6. Hedging Transactions Hedging arrangements include any swap, forward, option, future, collar, exchange fund or other derivative transactions or arrangements that hedge or offset, or are designed to hedge or offset, any decrease in the market value of shares of the Corporation’s common stock, or otherwise transfer to another, in whole or in part, any of the economic consequences of ownership of any shares of the Corporation’s common stock at the same time the director or employee holds the stock. The Corporation’s directors and employees may not enter into any hedging transactions with respect to the Corporation’s securities. 7. Margin Accounts and Pledges Securities purchased on margin may be sold by the broker without the customer’s consent if the customer fails to meet a margin call. Similarly, securities held in an account which may be borrowed against or are otherwise pledged (or hypothecated) as collateral for a loan may be sold in foreclosure if the borrower defaults on the loan. Accordingly, if a person purchases securities on margin or pledges them as collateral for a loan, a margin sale or foreclosure sale may occur at a time when such person is aware of material non-public information or otherwise not permitted to trade in the Corporation’s securities. The sale, even though not initiated at the person’s request, is still a sale for such person’s benefit and may subject such person to liability under the insider trading rules if made at a time when such person is aware of material non-public information. Similar cautions apply to a bank or other loans for which a person has pledged stock as collateral. Because of these risks, you should consult with the Corporation’s Legal Department and your own outside legal advisor prior to engaging in any such transactions. II. Section 16 Reporting Persons and Designated Employees In addition to the policies set forth in Section I of this Policy, the following sets forth additional restrictions applicable to directors, executive officers, the principal accounting officer and Designated Employees. 1. General In addition to the trading restrictions and policies which apply to all directors and employees as outlined in Section I above, the Corporation requires that (i) all Section 16 Reporting Persons (defined below) and Designated Employees may only trade in the Corporation’s securities during Window Periods (as defined below) and (ii) all Section 16 Reporting Persons must obtain prior written approval to purchase, sell, gift or otherwise acquire, transfer or dispose of the Corporation’s securities. “Section 16 Reporting Persons” are the Corporation’s directors, executive officers and principal accounting officer.

765324966 6 The Window Periods and, for Section 16 Reporting Persons, the pre-clearance requirement applies not only to transactions engaged in by such persons (directly or indirectly, through Rule 10b5-1 plans or otherwise), but also to transactions engaged in by their Immediate Family and Controlled Accounts. Any violation of the securities trading policy or failure to comply with the approval process may result in serious civil or criminal penalties under the law. 2. Window Periods Section 16 Reporting Persons and Designated Employees may only trade, transfer and gift the Corporation’s securities during a Window Period (or pursuant to a valid Rule 10b5-1 plan adopted during an open Window Period). A window period generally begins with the trading day on the New York Stock Exchange that is at least one full trading day after the day on which the Corporation makes a public news release of its quarterly or annual earnings for the prior fiscal quarter or fiscal year, as the case may be (“Window Period”). That same trading window closes 14 calendar days prior to the end of the then current fiscal quarter. After the close of the Window Period, Section 16 Reporting Persons and Designated Employees may not purchase, sell, gift or otherwise acquire, transfer or dispose of any of the Corporation’s securities. The prohibition against trading on or tipping material non-public information applies even in a trading Window Period described above. For example, if a material acquisition or divestiture is pending or if a forthcoming publication in the financial press may affect the relevant securities market, you may not trade the Corporation’s securities (such occurrence may be referred to as a “blackout”). The Corporation may also close regular Window Periods or decide not to open regular Window Periods for some or all Section 16 Reporting Persons and Designated Employees if any such event occurs or appears likely. All those affected shall not trade in the Corporation’s securities while the suspension is in effect, and shall not disclose to others that the Corporation suspended trading for certain individuals. You should consult the General Counsel whenever you are in doubt. In order to assist you in complying with this Policy, the Corporation plans to deliver an e- mail (or other communication) notifying all Section 16 Reporting Persons and Designated Employees when the Window Period has opened and when the Window Period is scheduled to close. The Corporation’s delivery or non-delivery of these e-mails (or other communication) does not relieve you of your obligation to only trade in the Corporation’s securities in full compliance with this Policy. 3. Pre-Clearance Requirements In addition to the above, Section 16 Reporting Persons may only trade, transfer and gift the Corporation’s securities after obtaining pre-approval from the General Counsel or his designee (with any trades pursuant to a Rule 10b5-1 plan deemed approved upon the Corporation’s approval of the entry into such Rule 10b5-1 plan). Approval for trades, transfers and gifts of the Corporation’s securities will generally be granted only during a Window

765324966 7 Period and the transaction may only be performed during the Window Period in which the approval was granted. To the extent possible, requests for approval will be processed within two business days after receipt. If approved, the transaction must be completed within five business days, but in no event after the expiration of the applicable Window Period and in no event if the person comes into possession of material, non-public information or if the pre-clearance is withdrawn. A form of “Request for Approval” is attached to this memorandum. Prior to the opening of each Window Period, the Corporation plans to deliver a communication notifying all Section 16 Reporting Persons to whom pre-clearance requests should be directed. Approval of pre- clearance requests is in the sole discretion of the Corporation. 4. Hardship Exemptions Those subject to the Window Periods or a blackout pursuant to this Section II may request a hardship exemption for periods outside the Window Periods or during a blackout, as applicable, if they are not in possession of material non-public information and are not otherwise prohibited from trading pursuant to this Policy. Hardship exemptions are granted infrequently and only in exceptional circumstances. Any request for a hardship exemption should be made to the General Counsel. The General Counsel is under no obligation to approve any request for a hardship exemption. 5. Stock Options Section 16 Reporting Persons and Designated Employees may exercise and hold stock options without regard to the Window Periods where the exercise price and applicable withholding tax are paid in cash. “Broker’s cashless exercises” and option exercises where securities are traded in order to pay the exercise price or withholding taxes are subject to pre- approval, must be performed during a Window Period and at a time when the holder is not in possession of material, non-public information, and must be in accordance with the applicable provisions of the Corporation’s equity plans. 6. Margin Accounts and Pledges Because of the heightened risks associated with pledges and margin accounts, no Section 16 Reporting Person or Designated Employee, whether or not in possession of material non- public information, may purchase the Corporation’s securities on margin, or borrow against any account in which the Corporation’s securities are held, or pledge the Corporation’s securities as collateral for a loan, without first obtaining pre-clearance and such transaction must occur during a Window Period and at a time when the holder is not in possession of material, non-public information. Request for approval must be submitted to the General Counsel at least two weeks prior to the execution of the documents evidencing the proposed pledge. The General Counsel is under no obligation to approve any request for pre-clearance and may determine not to permit the arrangement for any reason. Approvals will be based on the particular facts and circumstances of the request, including, but not limited to, the percentage amount that the securities being pledged represent of the total number of the Corporation’s securities held by the

765324966 8 person making the request and the financial capacity of the person making the request. Notwithstanding the pre-clearance of any request, the Corporation assumes no liability for the consequences of any transaction made pursuant to such request. 7. Requirements for Section 16 Reporting Persons Each Section 16 Reporting Person is personally responsible for his or her Section 16 reporting compliance. The timely reporting of transactions requires tight interface with brokers handling transactions for our Section 16 Reporting Persons. In order to facilitate timely compliance by the Section 16 Reporting Persons with the requirements of Section 16 of the Exchange Act, Section 16 Reporting Persons should instruct their brokers to comply with the following requirements: • Not to enter any order (except for orders under active Rule 10b5-1 plans) without first verifying with the Corporation that the transaction was pre- cleared and complying with the brokerage firm’s compliance procedures (e.g., Rule 144); and • To report as soon as practicable, but in any event before the opening of business on the day after the execution of the transaction to the Corporation in writing via e-mail to Legal@vestis.com, the complete details (i.e., date, type of transaction, number of shares and price) of every transaction involving the Corporation’s stock, including gifts, transfers, pledges and all Rule 10b5-1 transactions. Because it is the legal obligation of the reporting person to cause this filing to be made, Section 16 Reporting Persons are strongly encouraged to confirm following any transaction that the broker has immediately e-mailed the required information to the Corporation. 8. Prohibition on Short Swing Profits Section 16 Reporting Persons of the Corporation are required to comply with the reporting obligations and limitations on short-swing transactions set forth in Section 16 of the Exchange Act. A Section 16 Reporting Person who purchases and sells the Corporation’s securities within a six-month period must disgorge all profits to the Corporation whether or not such Section 16 Reporting Person had knowledge of any material non-public information. III. Potential Criminal And Civil Liability, Disciplinary Action 1. Individual Responsibility Each person is individually responsible for complying with the securities laws and this Policy, regardless of whether the Corporation has prohibited trading by that person or any other persons. Trading in securities during the window periods and outside of any suspension periods should not be considered a “safe harbor.” You are reminded that, whether or not during a window period, no person may trade securities on the basis of material non-public information.

765324966 9 Also bear in mind that any proceeding alleging improper trading will necessarily occur after the trade has been completed and is particularly susceptible to second-guessing with the benefit of hindsight. Therefore, as a practical matter, before engaging in any transaction all persons should carefully consider how enforcement authorities and others might view the transaction in hindsight. Further, whether or not a person possesses material non-public information, it is advisable that all persons invest in the Corporation’s securities or the securities of any company that has a substantial relationship with the Corporation from the perspective of a long term investor who would like to participate over time in the Corporation’s or such company’s earnings growth. 2. Controlling Persons The securities laws provide that, in addition to sanctions against an individual who trades illegally, penalties may be assessed against what are known as “controlling persons” with respect to the violator. The term “controlling person” is not defined, but includes employers (i.e., the Corporation), its directors, officers and managerial and supervisory personnel. The concept is broader than what would normally be encompassed by a reporting chain. Individuals may be considered “controlling persons” with respect to any other individual whose behavior they have the power to influence. Liability can be imposed only if two conditions are met. First, it must be shown that the “controlling person” knew or recklessly disregarded the fact that a violation was likely. Second, it must be shown that the “controlling person” failed to take appropriate steps to prevent the violation from occurring. For this reason, the Corporation’s supervisory personnel are directed to take appropriate steps to ensure that those they supervise understand and comply with the requirements set forth in this Policy. 3. Potential Sanctions a. Liability for Insider Trading and Tipping. Insiders, controlling persons and the Corporation may be subject to civil penalties, criminal penalties and/or jail for trading in securities when they have material non-public information or for improper transactions by any person (commonly referred to as a “tippee”) to whom they have disclosed material non-public information, or to whom they have made recommendations or expressed opinions on the basis of such information about trading securities. The SEC has imposed large penalties even when the disclosing person did not profit from the trading. The SEC, the stock exchanges and the Financial Industry Regulatory Authority use sophisticated electronic surveillance techniques to uncover insider trading. b. Possible Disciplinary Actions. The Corporation’s employees and Board members who violate this Policy will be subject to disciplinary action, up to and including termination of employment for cause, whether or not such person’s failure to comply results in a violation of law. Needless to say, a violation of law, or even an SEC investigation that does not result in prosecution, can tarnish one’s reputation and irreparably damage a career.

765324966 10 IV. Conclusion We expect all of the Corporation’s employees and Board members to abide by the foregoing trading restrictions and policies. Any violation may result in immediate dismissal and may subject you to both civil and criminal penalties. In addition, please note that during the course of our commercial relationship with clients, you may obtain material non-public information that could affect the future financial performance of such clients. Please be advised that any trading on the basis of such information may violate the United States securities laws. Any questions concerning the trading restrictions and policies set forth above should be directed to the persons listed below. You should not try to resolve any uncertainties on your own. If you have questions, please contact Ed Friedler at ed.friedler@vestis.com Effective Date: September 29, 2023 Amended and Restated: May 1, 2024

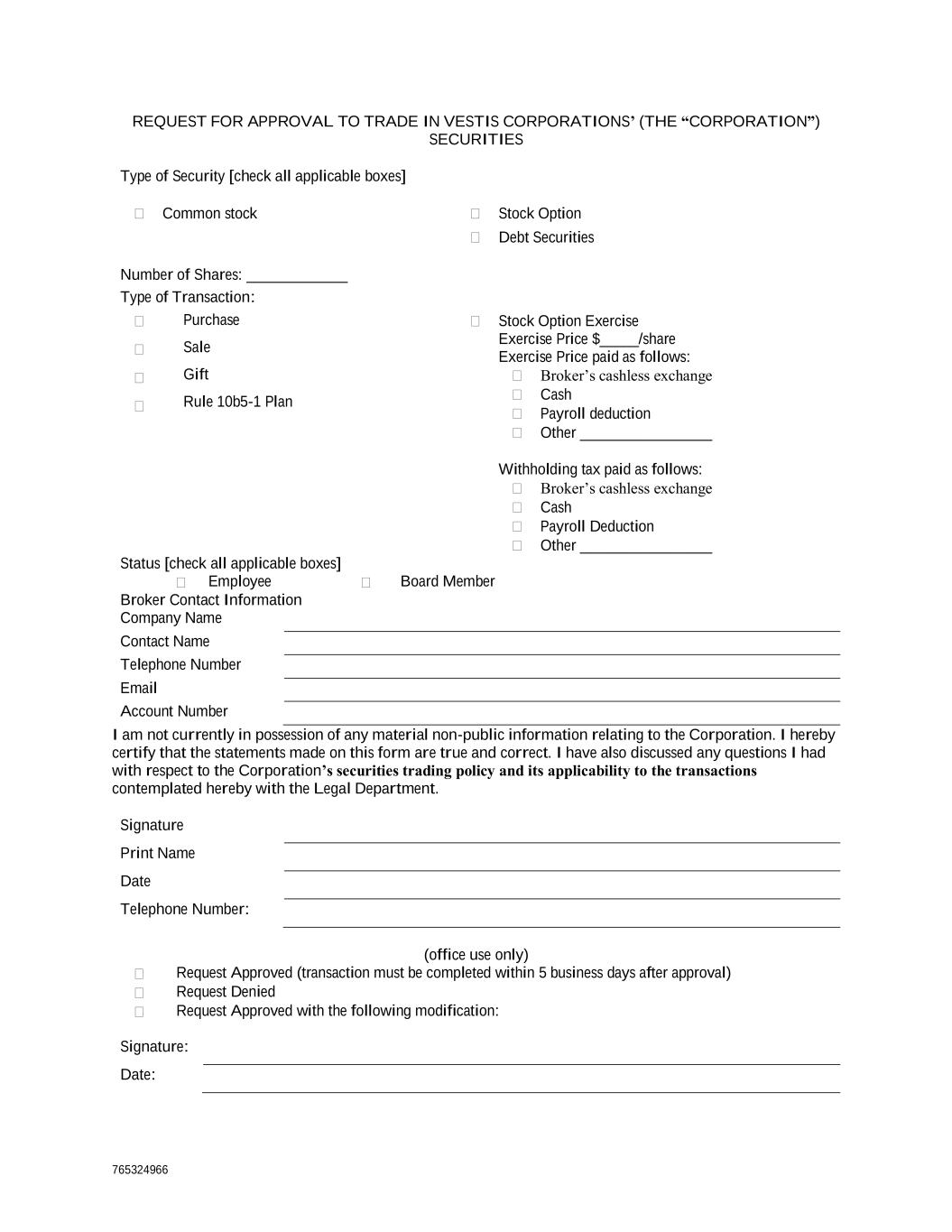

765324966 REQUEST FOR APPROVAL TO TRADE IN VESTIS CORPORATIONS’ (THE “CORPORATION”) SECURITIES Type of Security [check all applicable boxes] Common stock Stock Option Debt Securities Number of Shares: _____________ Type of Transaction: Purchase Sale Gift Rule 10b5-1 Plan Stock Option Exercise Exercise Price $_____/share Exercise Price paid as follows: Broker’s cashless exchange Cash Payroll deduction Other _________________ Withholding tax paid as follows: Broker’s cashless exchange Cash Payroll Deduction Other _________________ Status [check all applicable boxes] Employee Board Member Broker Contact Information Company Name Contact Name Telephone Number Email Account Number I am not currently in possession of any material non-public information relating to the Corporation. I hereby certify that the statements made on this form are true and correct. I have also discussed any questions I had with respect to the Corporation’s securities trading policy and its applicability to the transactions contemplated hereby with the Legal Department. Signature Print Name Date Telephone Number: (office use only) Request Approved (transaction must be completed within 5 business days after approval) Request Denied Request Approved with the following modification: Signature: Date:

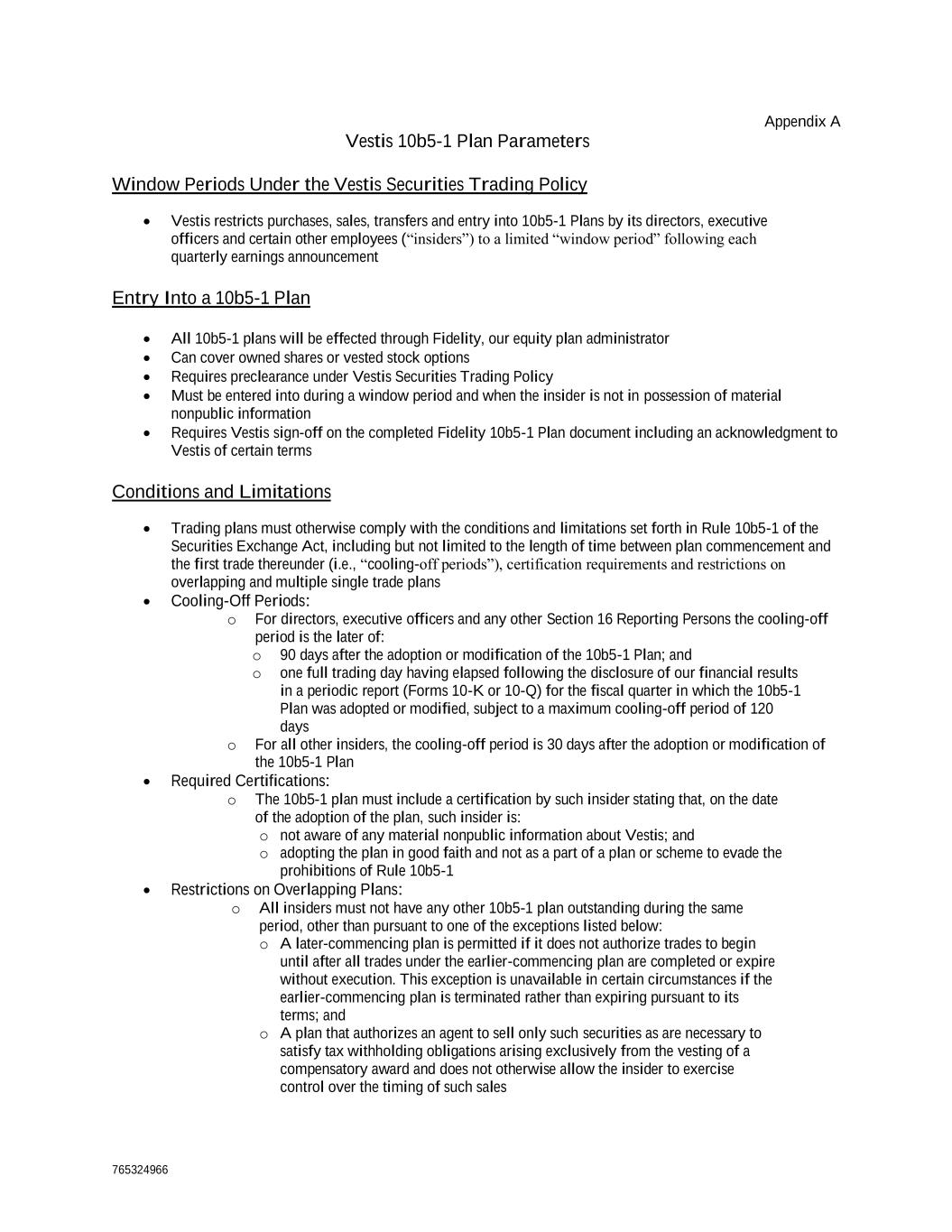

765324966 Appendix A Vestis 10b5-1 Plan Parameters Window Periods Under the Vestis Securities Trading Policy • Vestis restricts purchases, sales, transfers and entry into 10b5-1 Plans by its directors, executive officers and certain other employees (“insiders”) to a limited “window period” following each quarterly earnings announcement Entry Into a 10b5-1 Plan • All 10b5-1 plans will be effected through Fidelity, our equity plan administrator • Can cover owned shares or vested stock options • Requires preclearance under Vestis Securities Trading Policy • Must be entered into during a window period and when the insider is not in possession of material nonpublic information • Requires Vestis sign-off on the completed Fidelity 10b5-1 Plan document including an acknowledgment to Vestis of certain terms Conditions and Limitations • Trading plans must otherwise comply with the conditions and limitations set forth in Rule 10b5-1 of the Securities Exchange Act, including but not limited to the length of time between plan commencement and the first trade thereunder (i.e., “cooling-off periods”), certification requirements and restrictions on overlapping and multiple single trade plans • Cooling-Off Periods: o For directors, executive officers and any other Section 16 Reporting Persons the cooling-off period is the later of: o 90 days after the adoption or modification of the 10b5-1 Plan; and o one full trading day having elapsed following the disclosure of our financial results in a periodic report (Forms 10-K or 10-Q) for the fiscal quarter in which the 10b5-1 Plan was adopted or modified, subject to a maximum cooling-off period of 120 days o For all other insiders, the cooling-off period is 30 days after the adoption or modification of the 10b5-1 Plan • Required Certifications: o The 10b5-1 plan must include a certification by such insider stating that, on the date of the adoption of the plan, such insider is: o not aware of any material nonpublic information about Vestis; and o adopting the plan in good faith and not as a part of a plan or scheme to evade the prohibitions of Rule 10b5-1 • Restrictions on Overlapping Plans: o All insiders must not have any other 10b5-1 plan outstanding during the same period, other than pursuant to one of the exceptions listed below: o A later-commencing plan is permitted if it does not authorize trades to begin until after all trades under the earlier-commencing plan are completed or expire without execution. This exception is unavailable in certain circumstances if the earlier-commencing plan is terminated rather than expiring pursuant to its terms; and o A plan that authorizes an agent to sell only such securities as are necessary to satisfy tax withholding obligations arising exclusively from the vesting of a compensatory award and does not otherwise allow the insider to exercise control over the timing of such sales

765324966 • Restrictions on Single Trade Plans o All insiders must not have more than one single-trade Rule 10b5-1 plan during any 12-month period1 Duration • A minimum of 6 months and a maximum of 1 year Modification • Requires preclearance under Vestis Securities Trading Policy • Must occur during a window period and when the insider is not in possession of material nonpublic information • Must receive approval from the Vestis General Counsel or their designee Termination • Requires Vestis Legal Department preclearance • Seller should discuss with personal legal advisor • Can only terminate a 10b5-1 Plan under extraordinary circumstances • Required to wait one year after termination before entering into another 10b5-1 Plan Trading Outside an Existing 10b5-1 Plan • Any such external trading after the applicable cooling-off period must be approved by the Vestis General Counsel or their designee in advance and it is expected that such approval will rarely be granted 1 A single trade plan is one that is “designed to effect” the open-market purchase or sale of the total amount of securities as a single transaction. The SEC notes that, for this purpose, a plan is “designed to effect” the purchase or sale of securities as a single transaction when the contract, instruction, or plan “has the practical effect of requiring such a result.” In contrast, a plan is not designed to effect a single transaction where the plan leaves the agent discretion over whether to execute the contract, instruction, or plan as a single transaction.